Threats and intimidation to pay your tax bill? How to spot tax season scams

During the income tax filing season, scammers pose as representatives of the Canada Revenue Agency (CRA) in an attempt to trick you into sending payment for fictitious "debts" or into providing sensitive personal information that they can use to commit fraud. Learn more on how to spot tax season scams and what to do if you are the victim of fraud.

Cyber security awareness quizzes

Discover a new quiz site to help Canadians and Canadian small businesses protect against phishing scams. The Canadian Bankers Association has created four quizzes for Canadians to learn more about cyber fraud and how to prevent becoming a victim. Quiz #2: Social engineering: a peek behind the curtain Quiz # 3: Protecting your small business from phishing attacks Quiz #4: How to protect yourself and others

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. Here is some basic information to get you started. A list of bank resources at the end of this article may also help with the financial transition to Canada.

Cyber security awareness

The Canadian Bankers Association has created a new Cyber Security Awareness Quiz site to test your knowledge and ability to spot a “phishy” email, message or text.

Cyber security & fraud prevention learning guide

Banks take fraud very seriously and have highly sophisticated security systems and teams of experts to protect you from financial fraud. As a banking customer, there are also simple steps you can take to recognize cyber crime and protect your personal information and your money. Educating yourself, your family and your employees about cyber safety can seem overwhelming, but it doesn’t have to be that complicated and the CBA has developed a learning path to help.

Beware of One Time Passcode scams with these tips

While cyber criminals are always looking for ways to trick you into revealing information they can use to access your accounts, we have a few simple tips to avoid getting tricked by “one time passcode” scams that you may encounter while attempting to access your accounts securely.

Cyber security toolkit

There are also simple steps you can take to recognize cyber threats and protect yourself. With a cyber hygiene checklist and tips on how to spot common scams, the CBA’s Cyber Security Toolkit can help you protect against online financial fraud.

How Canadians bank

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world. This survey and other findings form the basis of How Canadians Banks, a biannual study by the Canadian Bankers Association and Abacus Data that examines the banking trends and attitudes of Canadians.

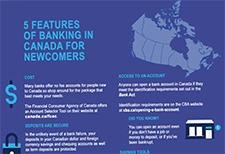

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the Canadian banking system.

Making more purchases online? Beware of fake websites and phony retailer apps

Many of us have shifted some of our shopping online during the pandemic – it’s easy and very often you can have items delivered right to your door. Criminals are taking advantage of the increased popularity of online shopping by creating fake websites and apps that look authentic but are just a ploy to steal your personal information. The Canadian Banker's Association helps you identify fake websites and apps and shares tips on how to protect yourself while shopping online and what to do if you are a victim of an online shopping scam.

Debt got you down?

The CBA partnered with Credit Counselling Canada, an association of accredited non-profit credit counselling agencies, to offer the Debt and Money Quiz. The online tool helps Canadians assess their financial health and provides recommendations to help those who are struggling financially. Take a short “Yes” or “No” quiz to find out if you need support managing money and debt. See how you compare with other quiz respondents.

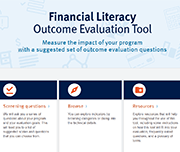

Financial Literacy Outcome Evaluation Tool

The Financial Literacy Outcome Evaluation Tool offers organizations a collection of evidence-based financial literacy outcomes and indicators. The tool guides users through a series of questions about their program and evaluation goals and then suggests scales (sets of questions) and individual questions they can use.