Discover financial empowerment resources

Discover financial empowerment resources

This 90-minute webinar provides frontline practitioners with foundational knowledge and skills to support Canadians living on a low income in accessing benefits. Participants will learn the importance of access to benefits for individuals and families, review key skills and opportunities for...

This case study explores how automatic tax filing and administration of tax benefits could greatly reduce the burden on the charitable and public sectors, and expand the number of people receiving income benefits for which they are...

Every year, thousands of people in Canada miss out on tax benefits that can significantly increase their income or reduce the amount they owe. For people living on a low income, filing a tax return can mean thousands of dollars more. Check out these resources -- infographics, posters, and social...

Jointly authored by Prosper Canada and AFOA Canada, this 2018 federal budget submission provides information and recommendations for the increase of benefits take-up for Indigenous...

This 90-minute webinar provided frontline practitioners with foundational knowledge and skills to support Canadians living on a low income in accessing benefits. Participants learned the importance of access to benefits for individuals and families, reviewed key skills and opportunities for...

This report is about the barriers low-income individuals face when filing taxes in Canada and how these obstacles prevent them from accessing critical government benefits. It focuses on the experiences of food bank clients, highlighting both the personal and systemic challenges they encounter, and...

Your tax notice of assessment tells you many important things. Learn more about what’s in your notice of assessment and what to do if you need to make a change on your tax return or if you disagree with your assessment. Available in...

A culturally grounded resource to support Indigenous financial wellness. Braiding Mind, Body, and Spirit is a financial wellness bundle created by and for Indigenous individuals and communities. Developed with Indigenous teachings, community voices, and practical tools to support individuals,...

Seeking help on tax filing and accessing benefits in Manitoba? Click on 'Access this resource' to visit the Community Financial Counselling Services website for more...

The CRA has put together a website for what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. This includes information on tax exemption and who is eligible. There is also information on...

The CRA has launched taxology podcasts. These weekly informal sessions address different topics whether you’re starting your first job, doing your first return, or need a refresher on the basics. CRA hosts talk to experts to share tips and answer top questions to help listeners understand the...

This infographic provides a helpful visual summary of tax benefits that can add to income or reduce the taxes people in Canada pay when they file their tax return. The information is especially useful for people in Canada who: Are working or living on a low income; Live with a...

The findings in this report highlight the important role of Old Age Security in reducing poverty, with payments under this program making up a large share of annual income for older adults in Toronto’s lowest income deciles. However, too many eligible older adults in Toronto are not receiving OAS...

The Working Centre in Kitchener-Waterloo has been dedicated to aiding marginalized populations for over 40 years. In partnership with Prosper Canada, it embarked on an initiative to connect the populations they serve to government benefits and tax filing support. Recognizing the intricate...

The Canada Disability Benefit website is managed by Plan Institute, a national non-profit organization based in Burnaby, BC. The purpose is to provide individuals, families, and professionals across Canada with up-to-date information and resources on the Canada Disability Benefit (CDB). Their...

This 40-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

Almost all participants (Canadians and community-based organisations (CBOs)) voiced support for the idea of automatic enrolment because it would improve access to the benefit by streamlining the enrolment process for all eligible recipients. As eligible youth are from families experiencing low...

Maytree has compiled an advocacy toolkit to help you advocate for the Canada Disability Benefit (CDB). This toolkit consists of an introduction, additional resources and frequently asked questions and the toolkit. You may download the toolkit by jurisdiction on their website: Advocacy...

In November 2023, Prosper Canada hosted two national, virtual roundtable sessions on closing the gap in tax filing and improving benefits access for under-served populations. The roundtables brought together more than 50 participants from government, industry, and community organizations to start a...

Filing a tax return is one of the most important ways for Canadians to access income benefits. However, numerous barriers can make tax filing challenging, particularly for people living on low incomes. After engaging with 31 individuals, we discovered that there are disruptors and compounders that...

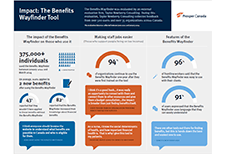

The external evaluation firm, Taylor Newberry Consulting, evaluated the Benefits Wayfinder between June 2022 and January 2024. This infographic showcases the feedback received based on feedback collected from 500 users and over 35 organizations across Canada. Impact: L'orienteur en mesures...

This article by Credit Canada answers many questions around tax filing. For instance, what happens if you don't file your taxes, or you don't pay any tax owing. It also addresses the benefits of filing your taxes. Click on "Access this resource" to learn...

Registered Retirement Savings Plans (RRSPs) are accounts registered with the Canada Revenue Agency (CRA) that help you save for retirement or other goals. To make it easier, the British Columbia Securities Commission has created a simple guide to understanding RRSPs. In this post you’ll learn...

After you file your tax return, Canada Revenue Agency processes it. It will issue you a refund or charge you for taxes owing, depending on the result of your return. While many returns are processed without a review, sometimes your tax return may be reviewed or audited. The Ontario Securities...

This CRA site has information on what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. There's also information on available tax filing...