Discover financial empowerment resources

Discover financial empowerment resources

Rising housing costs have had an impact on the ability of families to move. This article, using data from the Canadian Social Survey (CSS), illustrates how higher prices have disproportionately affected the moving decisions of young Canadians, particularly those experiencing financial...

In 2023, the Financial Consumer Agency of Canada (FCAC) and researchers from Carleton University developed and tested the effectiveness of brief, online interventions at improving the financial confidence, financial knowledge and positive financial behaviours of young women ages 16–25. To...

One of the core strategic priorities identified in FAIR Canada's 2023 -2028 Strategic Plan was to conduct and share research that provides deeper perspectives directly from individual investors about key policy matters that have an impact on them. As part of this effort, FAIR Canada commissioned an...

A government designs a great service or program to support its residents. Although many people qualify, the program receives just a few applications. How can we increase uptake? This is a common question the Behavioral Insights Team (BIT) has helped governments answer across many policy...

Individuals with lower incomes may face a range of economic challenges and barriers to upward mobility. Two types of services that may both contribute to the goal of improving individuals’ financial situations are employment and training (E&T) services, which have the goal of improving...

The first study of its kind measuring the impact of behaviorally informed advice on investor outcomes. It is common to seek the opinion of an expert when faced with a difficult decision. BEworks' research confirms this phenomenon in a range of consumer scenarios. For instance, parents faced with...

Internet use in Canada is prolific, with 94% of Canadians going online for personal use in 2022, up from 91% in 2018. Not only are more Canadians using the Internet since the COVID-19 pandemic, but more are managing their personal and household finances online. Based on data from the Canadian...

There are many reasons why someone might be struggling financially. Job loss, health challenges, or a sudden financial emergency could cause hardship, preventing someone from staying afloat. In times like these, it’s not uncommon for someone to ask for help from friends or family. Before agreeing...

In 2014, a group of non-retired Canadians aged 55 or older was asked about their financial expectations for retirement. New data from 2020 reveal how this same group of Canadians - now retired- is doing...

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said...

The rise of social media has given way to a new wave of financial influencers, or “finfluencers”, who leverage their platforms to share insights on finance and investing with their audiences. This report explores the relationship between Canadian retail investors and the financial information...

The pandemic has accelerated a polarization of jobs that has become a structural trend in the Canadian economy. Previous Cardus research has shown that this polarization of the labour market between low- and high-skilled occupations, with a declining share of jobs available for mid-skilled workers,...

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have...

A good deal of attention has been paid to the question of what these high rates of inflation in housing and food costs mean for Canadians. Much of the concern has focused on the implications for middle-income Canadians hoping to purchase a home, while squeezing their household budgets. But what do...

The Thriving or Surviving study uncovers the kitchen table issues that confront Canadians daily, revealing how the country is coping with concerns such as debt, savings, emergency funds and financial...

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world....

While much research has been conducted on how giving is correlated to factors like educational attainment or income level, the influence of ethnicity has been elusive. This research attempts to better understand how newcomers to Canada and second-generation Canadians perceive and approach giving...

This self-paced online course will help you learn about behavioural insights and how they can help you increase impact in simple, practical ways. In this self-paced learning experience, you will learn foundational skills and tools that you can apply immediately to your work, creating a long-lasting...

The key takeaways from the 2022 Canadian Retirement Survey are: Canadians are growing increasingly concerned about day-to-day cost of living impacting their ability to save for retirement. Capacity to save is dissolving for working Canadians, especially for those under 35 Inflation and...

Good financial planning starts with knowing what you spend. Try out this budget worksheet, prepared by the Ontario Securities Commission, to see the difference in your costs before you retire and after you stop...

If you have extra money, this calculator helps you decide whether to invest or pay off...

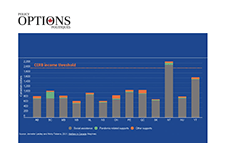

In 2020, the federal government spent over $160 billion on COVID-19 pandemic response measures. These expenses were critical in supporting recently unemployed workers and affected businesses in a time of uncertainty. However, supports through programs like the Canada Emergency Response Benefit...

The coronavirus pandemic has tested the limits of Canadians over the past 20 months. What began as a health crisis quickly morphed into an economic crisis, with the spread of COVID‑19 shocking large segments of the economy and leaving many without paycheques. While no generation has been...

The Financial Consumer Agency of Canada (FCAC) has published a pilot study on the use and understanding of Buy Now Pay Later (BNPL) services in Canada as part of the Agency’s research on emerging consumers trends. Similar to instalment loans, BNPL services allow consumers to purchase goods and...

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual...