Discover financial empowerment resources

Discover financial empowerment resources

The Behavioural Insights Team, in conjunction with Fair4All Finance, have worked with three community finance providers to launch a new customer engagement support guide to better improve customer engagement using insights from behavioural science. Building on our work with three lenders, this...

Make good financial decisions by getting the facts. Whether you’re deciding which account or credit card to choose, or figuring out if you can afford that mortgage this year or next, ATB has the tool or resource to help you get it right. Head to the ATB website to access these tools and...

A government designs a great service or program to support its residents. Although many people qualify, the program receives just a few applications. How can we increase uptake? This is a common question the Behavioral Insights Team (BIT) has helped governments answer across many policy...

This 90-minute webinar is provided on a quarterly basis and is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and...

Maytree has compiled an advocacy toolkit to help you advocate for the Canada Disability Benefit (CDB). This toolkit consists of an introduction, additional resources and frequently asked questions and the toolkit. You may download the toolkit by jurisdiction on their website: Advocacy...

This handout outlines the common warning signs of financial abuse, tips for identifying abusers, and suggested prevention...

Banks in Canada are working around the clock on the prevention and detection of fraud and cyber security threats and work closely with each other and with bank regulators, law enforcement and all levels of government to protect the financial system and their customers from financial crimes. There...

This groundbreaking initiative is aimed at transforming emergency shelter services across Canada to better uphold the rights of women and gender-diverse people. Emergency shelters play a critical role in providing immediate support, but they are often overwhelmed and under-resourced. In response...

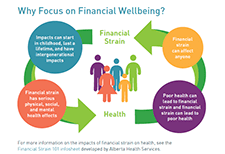

More and more people are having difficulties in covering day-to-day expenses, saving money, and paying down debts. The Financial Wellbeing Café Scientifique was an opportunity to bring people together to talk about how to drive action on financial wellbeing in Canada. The event included a...

There are many ways to invest. Your choices will depend on your goals, your timeline and your willingness and ability to accept risk. It’s important to know some basics. This article by CIRO outlines the 5 key principles of investing: can you afford it, diversification, invest for the long term,...

Individuals with lower incomes may face a range of economic challenges and barriers to upward mobility. Two types of services that may both contribute to the goal of improving individuals’ financial situations are employment and training (E&T) services, which have the goal of improving...

Investment firms are required to provide to each client an annual summary of all fees paid the previous year for services and advice. These requirements result in greater transparency about what you are paying, either directly or indirectly, for investment advice and other...

No matter what type of investment you buy or advice you receive, you will be charged fees. There are many different types of fees and ways that you can be charged. Use this calculator by the Ontario Securities Commission to estimate how these fees can affect your investments over...

The 2021-2023 Building Financial Wellness in First Nations (FWFN) project - led by Prosper Canada and funded by IG Wealth Management - aimed to integrate culturally appropriate financial wellness supports into existing services in Manitoba and Ontario First Nation...

In November 2023, Prosper Canada hosted two national, virtual roundtable sessions on closing the gap in tax filing and improving benefits access for under-served populations. The roundtables brought together more than 50 participants from government, industry, and community organizations to start a...

Filing a tax return is one of the most important ways for Canadians to access income benefits. However, numerous barriers can make tax filing challenging, particularly for people living on low incomes. After engaging with 31 individuals, we discovered that there are disruptors and compounders that...

The Office of the Investor at the Canadian Investment Regulatory Organization (CIRO) engaged with Innovative Research Group to conduct the organization’s first national investor survey. The objective of this general population (and particularly investors) survey research is to help CIRO better...

The disability tax credit (DTC) is an important program for those facing severe and prolonged physical or mental impairment. Some individuals face unique barriers when it comes to completing their application and claiming the credit. On this page, the CRA is correcting some of the most common myths...

Maytree recently published the latest count of social assistance recipients in Canada. Learn how many people in each province or territory were receiving social assistance in 2022-23, and how those numbers have changed over...

CIRO sets and enforces rules for the business, trading and financial conduct of Member firms and their representatives across Canada. These rules protect investors. Access this resource to learn more about the benefits of working with a CIRO...

CIRO works within the Canadian regulatory framework to help contribute to investor confidence and security. In collaboration with these other organizations, CIRO is committed to the protection of investors and maintaining the integrity of the Canadian capital markets. We want to build Canadians’...

CIRO is the national self-regulatory organization (SRO) that oversees investment dealers, mutual fund dealers and trading activity on Canada’s debt and equity marketplaces. CIRO works to protect investors. CIRO sets and enforces rules for the business and financial conduct of Member firms and...

If you have suffered a financial loss because your investment advisor or firm acted improperly, you may be eligible to receive financial compensation. Read this article by CIRO to learn...

While CIRO’s mandate includes setting and enforcing market integrity rules regarding trading activity on Canadian debt and equity marketplaces, they do not have jurisdiction over specific issuers of securities or their directors, officers or employees. Learn about available options if you wish...

FCAC’s new webpage, Choosing a financial institution, will help consumers determine which type of financial institution best meets their needs. The topics covered include: Identifying the financial products and services you need Deciding if you want all your products and services with one...