Discover financial empowerment resources

Discover financial empowerment resources

Mariposa is an AI agent built by Credit Canada, the country’s first and longest-standing non-profit credit counselling agency. Access free, 24/7 AI-powered financial advice and get a personalized debt assessment to help you take the next step toward being...

Buy Now Pay Later apps like Klarna and Afterpay have become ubiquitous since the pandemic, allowing users to pay for items in small installments over time instead of footing the bill all at once. But now, some financial experts are sounding the alarm that these easy-to-use apps can lead to...

A culturally grounded resource to support Indigenous financial wellness. Braiding Mind, Body, and Spirit is a financial wellness bundle created by and for Indigenous individuals and communities. Developed with Indigenous teachings, community voices, and practical tools to support individuals,...

Credit unions offer many of the same services as a bank such as cash deposits, investments, mortgages and more. The moment you become a credit union member and make a deposit, your insurable deposits are protected. FSRA, through the Deposit Insurance Reserve Fund (DIRF), provides coverage of...

If you are looking to work with a loan and trust company for deposits or loans, FSRA is responsible for registering all federally incorporated loan and trust companies that do business in Ontario. They enforce the Loan and Trust Corporations Act that govern loan and trust companies. See FSRA's...

The Behavioural Insights Team, in conjunction with Fair4All Finance, have worked with three community finance providers to launch a new customer engagement support guide to better improve customer engagement using insights from behavioural science. Building on our work with three lenders, this...

This handbook from Money Mentors Alberta outlines the steps to rebuild your...

One of the goals of The Money and Pensions Service (MaPS) is to provide better debt advice. While debt advice is available in many different forms, many people who could benefit from debt advice do not seek help. In this study, we sought to better understand the barriers and drivers to people...

Looking to give your credit score a lift? Credit Canada can show you how to obtain your credit score, what it means, and how to get it into better shape. Click on "Access this resource" to learn...

Debt can be a useful financial tool. Loans can help you buy a car or a home. And if you use credit cards, you can sometimes collect other benefits like travel miles or points you can spend. However, too much debt can make it difficult to save money and limit your financial options now and in the...

Economies around the world have had some rough years recently. From a global pandemic, a bout of inflation, a disruption in supply chains, coping with a European war and ongoing concern about global financial stability. The Canadian economy has weathered these storms as well, if not better than...

This free new course for newcomers consists of 4 short modules that should take 10-15 minutes each to complete. Each module includes short case studies, mini quizzes and other interactive elements. The topics for each module are: Essentials of credit in Canada How to build your credit...

This article by Credit Canada helps determine whether it's better to save for the future or pay off existing debts. The "priority pyramid" is a method of visualizing your areas of financial focus from most important to least...

Between the high cost of living and inflation, many of us are struggling with debt. But with financial advice available everywhere - from your uncle’s friend to social media influencers, it can be easy to feel overwhelmed and hard to know whose advice you can trust. Learning some key warning...

Did you know Canadians have the highest level of household debt in the G7? While debt can be useful it can also be stressful. Consider trying some solid strategies to help you tackle your debt and get on firmer financial...

There are many options to deal with debt, but if it sounds too good to be true—it probably is. Ask questions and shop around to avoid paying unnecessary fees. The Office of the Superintendent of Bankruptcy Canada has put together a host of useful tools around debt based on an individual's...

The Office of the Superintendent of Bankruptcy (OSB) is continuing its efforts to help Canadians experiencing serious financial difficulties find the right debt solution. These efforts include increasing consumer awareness about the unregulated Debt Advisory Marketplace and helping consumers...

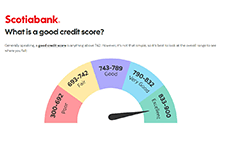

While your credit score is a number to quickly show how creditworthy you are, your credit report is more detailed. It covers your entire credit profile and includes information such as personal information, credit account (including credit cards, lines of credit, mortgages...),...

Many of us struggle to talk about money, especially when it comes to talking about debt. It is when debt becomes too much for us to manage, or when we do not have a plan to pay it off, that it can become stressful and even overwhelming. This is when it is time to have those tough conversations and...

Managing debt doesn't have to be overwhelming. These tips and tools from the Ontario Securities commission can help you borrow wisely and pay off debt more...

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have...

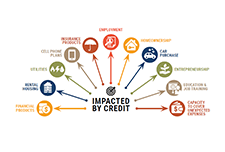

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that...

The Thriving or Surviving study uncovers the kitchen table issues that confront Canadians daily, revealing how the country is coping with concerns such as debt, savings, emergency funds and financial...

Debt Consolidation is the process of combining multiple debts into one. Use this calculator to calculate what your new monthly payments would be, how soon you could be debt free, and how much your total interest amount would be when you consolidate your...

The CBA partnered with Credit Counselling Canada, an association of accredited non-profit credit counselling agencies, to offer the Debt and Money Quiz. The online tool helps Canadians assess their financial health and provides recommendations to help those who are struggling...