Ten frugal habits to save money

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said they would put it in savings or invest it. With inflation as high as it has been in over 40 years, saving money is becoming increasingly difficult for some. This article lists ten frugal habits to help you save.

Retirement savings course

The Association of Canadian Pension Management (ACPM) launched its new Retirement Savings Course to empower Canadians wishing to learn the basics of retirement savings and to foster awareness of the importance of retirement income savings at any age. Course highlights: The free course will provide you an overview of the building blocks of retirement savings and insight into the role that government pensions and workplace pension plans may have for your future or that of those you care about.

Survey on savings for persons with disabilities

Residents in Canada who have a severe and prolonged mental or physical disability are eligible for the Disability Tax Credit (DTC). This opens the door to other programs, one of which is the RDSP. Less than one-third of eligible residents in Canada (up to age 59) have a Registered Disability Savings Plan (RDSP)—about 31.5% in 2020. To understand why more eligible residents in Canada do not have an RDSP, Employment and Social Development Canada asked Statistics Canada to conduct the Survey on Savings for Persons with Disabilities. Its goal was to collect data from residents in Canada who were eligible for an RDSP but did not open one. These respondents included both persons with disabilities and family members or others who care for persons with disabilities, since the holder of the plan may not be the same person as the beneficiary in all cases. These data show that, in general, eligible residents in Canada lack information about the RDSP, with many not being aware it exists and a substantial portion reporting not having enough information or money to open one.

Tax Time: An opportunity to Start Small and Save Up

This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being. This paper also provides a few examples of how Volunteer Income Tax Assistance (VITA) programs creatively used Bureau tools, resources and technical assistance to encourage savings as well as some of the results they reported. It provides insights from a subgroup of the programs in the cohort that collected additional information from consumers on their intent to save, the various types of accounts into which they saved, and the goals they were striving for by saving. Finally, this paper offers recommendations on some strategies that can be employed to increase people’s interest and commitment to saving during the tax preparation process.

Planning for tax-time savings

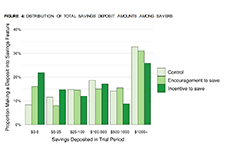

This report presents the results of a large-scale field experiment that the tax preparation company H&R Block (the Company) conducted in collaboration with the Consumer Financial Protection Bureau (the CFPB). The field experiment investigated whether customers could be encouraged, through consumer communications with and without the offer of a small financial incentive, to use a savings feature on a prepaid card to save a portion of their tax refunds from all sources, including state and federal refunds. The CFPB was particularly interested in whether consumers who receive the Earned Income Tax Credit (EITC) would be receptive to messages about saving.

How to use your tax refund to build your emergency savings

If you file your taxes in the United States, you can learn how your tax return can kickstart your savings. This guide from the Consumer Financial Protection Bureau walks you through some fast and easy ways to use your tax refund to increase your savings. This guide covers multiple topics including: why save your tax return, how to save money fast, affordable ways to file your taxes, and how to protect yourself from tax fraud.

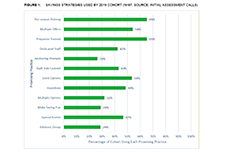

Evaluating Tax Time Savings Interventions and Behaviors

This report explores the behaviors and outcomes related to savings and financial well-being of low- and moderate-income (LMI) tax filers in the United States. Findings from research conducted by Prosperity Now, the Social Policy Institute at Washington University in St. Louis and SaverLife (formerly EARN) during the 2019 tax season are presented. This analysis is unique in that it compares tax filers' outcomes over time across three different tax-filing and savings program platforms: volunteer income tax assistance (VITA) sites, online tax filing through the Turbo Tax Free File Product (TTFFP), and SaverLife's saving program.

Incentivized Savings: An Effective Approach at Tax Time

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through a dedicated collaboration with ATB Financial, Aspire Calgary, Sunrise Community Link Resource Centre, Centre for Newcomers, and First Lutheran Church Calgary that made it all possible. This report shares results and highlights from the 2018 Tax Time Savings program. 93% of participants earned the maximum match of $500.

Tax Time: An opportunity to Start Small and Save Up

The Consumer Financial Protection Bureau’s continuing effort to encourage saving at tax time is now part of a larger Bureau initiative to support people in building liquid savings. The new initiative is called Start Small, Save Up. The vision for Start Small, Save Up is to increase people’s financial well-being through education, partnerships, research, and policy or regulatory improvements that increase people's opportunities to save and empower them to realize their personal savings goals. This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being.

Promise Accounts: Matched Savings to Help Families Get Ahead

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the racial wealth divide means creating saving pathways for low-income households to build wealth. Promise Accounts make some key changes to traditional matched savings programs. Specifically, these accounts would have features including:

VITA: A step-by-step guide to increase your impact

In this report, The Common Cents Lab and MetLife Foundation share findings from the experiments we have run over the past several years with VITA providers to improve tax-related outcomes. We encourage you to consider implementing these ideas and engaging in additional conversations about how to use behavioral science to increase financial capability for all taxpayers. The report outlines a series of interventions that exemplify

ways these best practices have been implemented in the field and

how to use behavioral science to further extend their impact. We’ve

organized these interventions into two categories:

Do Tax-Time Savings Deposits Reduce Hardship Among Low-Income Filers? A Propensity Score Analysis

A lack of emergency savings renders low-income households vulnerable to material hardships resulting from unexpected expenses or loss of income. Having emergency savings helps these households respond to unexpected events, maintain consumption, and avoid high-cost credit products. Because many low-income households receive sizable federal tax refunds, tax time is an opportunity for these households to allocate a portion of refunds to savings. We hypothesized that low-income tax filers who deposit at least part of their tax refunds into a savings account will experience less material and health care hardship compared to non-depositors. Six months after filing taxes, depositors have statistically significant better outcomes than non-depositors for five of six hardship outcomes. Findings affirm the importance of saving refunds at tax time as a way to lower the likelihood of experiencing various hardships. Findings concerning race suggest that Black households face greater hardship risks than White households, reflecting broader patterns of social inequality.