Introduction to investing: A primer for new investors

Whether you’re new to investing, or new to Canada, InvestingIntroduction.ca can help. Visit the Ontario Securities Commission's refreshed website and find resources to help you make more informed investment decisions and better protect your money. The information is available in 22 languages.

Investing and The COVID-19 Pandemic: Survey of Canadian Investors

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and trading activity of retail investors. Key findings include that 32 per cent of investors have experienced a decline in their financial situation during the pandemic while 16 per cent have experienced an improvement. Half of investors have not done any trading during the pandemic, but of those who have been trading, 63 per cent have increased their holdings.

Financial Literacy Month – 10th anniversary Resources

For the 10th anniversary of Financial Literacy Month in Canada, Financial Consumer Agency of Canada (FCAC) has released resources to help Canadians learn how to manage their finances in challenging times. Resources include the following topics:

COVID-19 Financial Resilience Hub

The Global Financial Literacy Excellence Center (GFLEC) focuses on financial literacy research, policy, and solutions. This toolkit contains suggestions and resources for managing personal finances and protection against the financial emergencies caused by COVID-19.

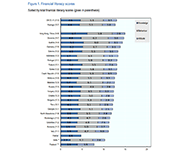

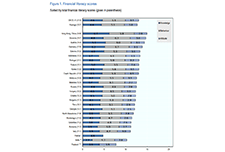

Launch of the OECD/INFE 2020 International Survey of Adult Financial Literacy

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018 OECD/INFE toolkit to collect cross-comparable data. The survey results report the overall financial literacy scores, as computed following the OECD/INFE methodology and definition, and their elements of knowledge, behaviour, and attitudes. The data used in this report are drawn from national surveys undertaken using and submitted to the OECD as part of a co-ordinated measurement exercise; as well as data gathered as part of the OECD/INFE Technical Assistance Project for Financial Education in South East Europe.

G20/OECD INFE Core Competencies Framework on financial literacy for Adults (aged 18+)

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to inform the development of a national strategy on financial education, improve programme design, identify gaps in provision, and create assessment, measurement and evaluation tools.

COVID-19 financial literacy resources

CPA Canada has put together resources to help manage your finances and provide you with the tools you need during this crisis – and beyond.

COVID-19 Financial Resource Centre

Credit Canada has pulled together financial information from trusted sources and released original content to help Canadians manage their finances during COVID-19.