Discover financial empowerment resources

Discover financial empowerment resources

This report summarizes the first results from the Canadian Survey on Working Conditions. Explore how different kinds of workers experience core dimensions of quality of employment, including exposure to physical risks, emotional demands, work schedules and hours, time pressures, co-worker support,...

The 2025 Report of the National Advisory Council on Poverty is progress report on 'Opportunity for All' – Canada’s First Poverty Reduction Strategy. It presents views on whom people turn to when they need support, how they access services, and if the existing benefits and programs meet their...

This OECD Economic Survey provides a comprehensive analysis of Canada's 2025 economic developments, with chapters covering key economic challenges and policy recommendations addressing these...

With February 2025 the thirteenth Index Release, the Institute’s Financial Resilience Index Model complements the national Financial Well-Being Studies instrument and the Financial Well-Being Index Model instruments. Access this resource to read the...

This report explores the barriers newcomers face in accessing credit, and opportunities for governments, financial institutions, settlement agencies, fintech, investors and funders, and community organizations to better respond to this growing segment of the...

What do we know about the millions of people working in Canada’s nonprofit sector? This report by Imagine Canada provides a detailed profile of these workers, including demographic and salary information, and uncovers how the nonprofit workforce differs significantly from the broader Canadian...

Many Canadians assume that poverty among seniors is a minor issue. That the income security system provides enough for the elderly to live with dignity. But this new report reveals a different reality: 430,000 seniors in Canada live below the Official Poverty Line. Why does seniors’ poverty...

Wellesley Institute’s Thriving in the City1 framework is a valuable tool for understanding what resources an individual needs to live a healthy life and assessing how the current policy environment meets these needs. While the previous report focused on working-age adults (25-40 years old),2 this...

The affordable housing crisis in Canada creates many challenges for millions of people trying to find a place to live that they can afford. For many marginalized renters, discrimination presents additional barriers making it even harder for them to find a home. To better understand these...

This article analyses results from the Canadian Housing Survey, 2022 , using new variables on homelessness and factors contributing to regaining and maintaining housing. The paper provides a descriptive overview of different types of homelessness experiences in Canada, highlighting select...

A poverty reduction strategy lays a foundation to build a community of best practices; it identifies gaps and leverages local knowledge. This case study unpacks the conditions that have led to the success of Niagara Region’s Poverty Reduction Strategy – specifically around its community...

Canada is facing housing affordability challenges. In 2021, one in five households (20.9%) lived in unaffordable housing, defined as spending 30% or more of household total income on shelter costs (Statistics Canada, 2022c). Some estimates have projected a need for an additional 3.5 million housing...

The COVID-19 pandemic and post-pandemic recovery were “feast and famine” for the budgets of low-income families and individuals across Canada. Because of the income support programs put in place to help Canadians affected by workplace shutdowns, the poverty rate fell to 6.4% in 2020, down by...

This research from early 2024 focuses on the perspectives of consumers as related to the individuals providing them with financial planning and/or financial advisory services. The research consisted of a survey of over 1,000 Ontario consumers, and two focus group discussions to supplement the...

Rising housing costs have had an impact on the ability of families to move. This article, using data from the Canadian Social Survey (CSS), illustrates how higher prices have disproportionately affected the moving decisions of young Canadians, particularly those experiencing financial...

The Financial Consumer Agency of Canada’s (FCAC) report examines and compares key measures of financial well-being for 3 groups of Canadians: homeowners with mortgages, homeowners without mortgages, and renters. The data shown here are derived from FCAC’s COVID-19 Financial Well-being Survey....

The Embedded Financial Coaching project builds on evidence that embedding financial coaching into employment services leads to stronger employment and financial well-being outcomes. This report provides insights on the project components including delivering financial coaching services, developing...

Women and girls are highlighted within Canada’s National Financial Literacy Strategy as a diverse population that can benefit from tailored approaches to strengthen financial resilience. To help close the gender gap, the Financial Consumer Agency of Canada (FCAC) developed and tested the benefits...

In 2023, the Financial Consumer Agency of Canada (FCAC) and researchers from Carleton University developed and tested the effectiveness of brief, online interventions at improving the financial confidence, financial knowledge and positive financial behaviours of young women ages 16–25. To...

The Working Centre in Kitchener-Waterloo has been dedicated to aiding marginalized populations for over 40 years. In partnership with Prosper Canada, it embarked on an initiative to connect the populations they serve to government benefits and tax filing support. Recognizing the intricate...

The CRA's Indigenous strategy takes inspiration from the United Nations Declarations on the Rights of Indigenous Peoples and contributes to the Government of Canada’s efforts to advance reconciliation. It presents an integrated approach to improve trust and ensure that our services are...

One of the core strategic priorities identified in FAIR Canada's 2023 -2028 Strategic Plan was to conduct and share research that provides deeper perspectives directly from individual investors about key policy matters that have an impact on them. As part of this effort, FAIR Canada commissioned an...

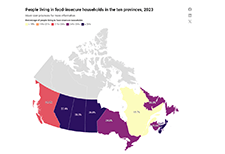

In 2023, 22.9% of people in the ten provinces lived in a food-insecure household. That amounts to 8.7 million people, including 2.1 million children, living in households that struggled to afford the food they need. With another year of rising food insecurity, the percentage of people affected is...

Almost all participants (Canadians and community-based organisations (CBOs)) voiced support for the idea of automatic enrolment because it would improve access to the benefit by streamlining the enrolment process for all eligible recipients. As eligible youth are from families experiencing low...

Savings are one of the strongest predictors of household financial resilience and well-being, yet Canadian households struggle to save due to an array of economic, behavioural and institutional factors. The Financial Consumer Agency of Canada (FCAC) created the National Financial Literacy...