Discover financial empowerment resources

Discover financial empowerment resources

The Financial Consumer Agency of Canada (FCAC) has published research insights that reveal where Canadians are turning for various types of financial advice. FCAC’s Spotlight on Canadians’ use of financial advice showcases data from the 2024 Canadian Financial Capability Survey (the CFCS), a...

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

Low-cost accounts cost a maximum of $4 per month in banking fees. The Government of Canada and certain financial institutions have an agreement to provide low-cost basic banking services. If you meet certain conditions, you may be eligible for a low-cost account at no cost. No-cost accounts have...

Women and girls are highlighted within Canada’s National Financial Literacy Strategy as a diverse population that can benefit from tailored approaches to strengthen financial resilience. To help close the gender gap, the Financial Consumer Agency of Canada (FCAC) developed and tested the benefits...

In 2023, the Financial Consumer Agency of Canada (FCAC) and researchers from Carleton University developed and tested the effectiveness of brief, online interventions at improving the financial confidence, financial knowledge and positive financial behaviours of young women ages 16–25. To...

Managing your finances means finding the right balance. Inflation and higher interest rates signal that you may need to adjust your budget to find the right balance between daily spending and paying down debt. The right balance will depend on your financial situation and goals. This selection of...

Take this self-assessment quiz to figure out how your financial literacy skills and knowledge measure up compared to other...

Most people know a little about investing, but they need to know more to be able to manage their investments to meet their goals. Try this quiz by the FCAC to see if your knowledge is basic or more...

View the 8 videos created by the Financial Consumer Association of Canada (FCAC) as part of the National Financial Literacy Strategy 2021-2026. Videos include: Make change that counts: Introducing FCAC’s National Financial Literacy Strategy Communicate in ways people understand Build...

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have...

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional...

Le français suit l’anglais. As of June 30, 2022, banks will be required to send electronic alerts to their customers to help them manage their finances and avoid unnecessary fees. Some banks have already started sending these alerts to their customers. The electronic alerts are part of the...

This webinar hosted by FCAC (originally broadcast on November 17, 2021) targets women who want to learn more about managing money and building saving habits. Guest speaker, personal financial expert, Rubina Ahmed-Haq has also contributed to Canada's financial literacy blog on "Women face unique...

The Financial Consumer Agency of Canada (FCAC) has published a pilot study on the use and understanding of Buy Now Pay Later (BNPL) services in Canada as part of the Agency’s research on emerging consumers trends. Similar to instalment loans, BNPL services allow consumers to purchase goods and...

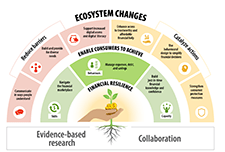

The Financial Consumer Agency of Canada’s (FCAC’s) mandate is to protect Canadian financial consumers and strengthen financial literacy. The National Strategy is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in...

The Review of Financial Literacy Research in Canada highlights past and current advancements in financial literacy research (produced by government and non-governmental stakeholders) while identifying existing gaps within the financial landscape. The overriding goal is to help strengthen the...

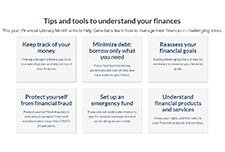

For the 10th anniversary of Financial Literacy Month in Canada, Financial Consumer Agency of Canada (FCAC) has released resources to help Canadians learn how to manage their finances in challenging times. Resources include the following topics: Keep track of your money Minimize...

This guide from the Financial Consumer Agency of Canada shares guidelines and financial tips to help Canadians during COVID-19. The topics include: getting through a financial emergency, where to ask questions or voice concerns, what to do if your branch closes, and...

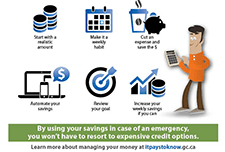

This infographic illustrates the importance of having an emergency fund and how to build...

The Financial Consumer Agency of Canada (FCAC) co-hosted the 2018 National Research Symposium on Financial Literacy on November 26 and 27, 2018 at the University of Toronto, in partnership with Behavioural Economics in Action at Rotman (BEAR). This report presents the key ideas and takeaways from...

The Financial Consumer Agency of Canada (FCAC)'s online tool helps you create a customized...

This report provides results from the 2019 Canadian Financial Capability Survey (CFCS). It offers a first look at what Canadians are doing to take charge of their finances by budgeting, planning and saving for the future, and paying down debt. While the findings show that many Canadians are acting...

Financial well-being is the extent to which you can comfortably meet all of your current financial commitments and needs while also having the financial resilience to continue doing so in the future. But it is not only about income. It is also about having control over your finances, being able to...

This calculator from the Financial Consumer Agency of Canada determines your mortgage payment and provides you with a mortgage payment...

Compare features for different chequing and savings accounts, including interest rates, monthly fees and transactions. Find an account that best suits your needs. Narrow your search, view search results, and compare your results using this account comparison tool from the Financial Consumer Agency...