Discover financial empowerment resources

Discover financial empowerment resources

A report based on 2021 Census data, about socioeconomic characteristics (e.g. poverty rates and earnings) among transgender men, transgender women and non-binary people, in comparison to cisgender men and...

Canada is facing housing affordability challenges. In 2021, one in five households (20.9%) lived in unaffordable housing, defined as spending 30% or more of household total income on shelter costs (Statistics Canada, 2022c). Some estimates have projected a need for an additional 3.5 million housing...

Employment and income experiences for persons with disabilities often differ from persons without disabilities. Barriers to accessibility within these areas often lead to lower employment rates and decreased income levels for persons with disabilities, in relation to persons without...

Using data primarily from the 2021 Canadian Housing Survey, this study applies a gender lens to examine the characteristics of Canadians living in subsidized housing. It examines the experiences of renters in subsidized housing and their satisfaction with their dwelling and neighbourhood, drawing...

This study uses the 2022 Portrait of Canadian Society Survey to examine the impact of rising inflation on the lowest income Canadians. Using multiple pre-pandemic data sources, the study takes a closer look at people living in the bottom family income quintile, examining their family income, debt...

Black History Month is an opportunity to highlight the contributions and accomplishments of Black Canadians and their communities. These Statistic Canada findings provide a brief overview of personal education, contributions to the scientific community, proportions in the front line staff, and...

Residents in Canada who have a severe and prolonged mental or physical disability are eligible for the Disability Tax Credit (DTC). This opens the door to other programs, one of which is the RDSP. Less than one-third of eligible residents in Canada (up to age 59) have a Registered Disability...

This study presents data on levels of household food insecurity in the 10 provinces from the September to December 2020 cycle of the Canadian Community Health Survey. In this survey, household food security status within the previous 12 months was measured using a scale that has been routinely used...

Canadians were more asset resilient just prior to the pandemic than they were at the turn of the millennium. That resilience continues to be tested as we enter the second year of the pandemic. For the purposes of this article, a household is asset resilient when it has liquid assets that are at...

Statistics Canada presents a demographic and social profile of Canada's diverse LGBTQ2+ communities based on published analyses. Much of the data in this release focus on LGB Canadians (lesbian, gay, bisexual), since Statistics Canada has been collecting detailed information on these communities...

Each year, some Canadians fall into low income, while others rise out of it. For example, over one-quarter (28.1%) of Canadians who were in low income in 2017 had exited it by 2018. This study examines the low income exit rate in Canada—an indicator that can be used to track the amount of time it...

The Canada Emergency Response Benefit program (CERB) was introduced to provide financial support to employees and self-employed workers in Canada who were directly impacted by the COVID-19 pandemic. This article examines the proportion of 2019 workers who received CERB payments in 2020 by various...

A highlight of some of the findings reported in this briefing: Disposable income declined for most households in the fourth quarter of 2020, with the largest losses for the lowest-income earners (-10.2%). Compensation of employees—of which wages and salaries make up the largest share—was...

The financial resources available to families with young children are an important factor affecting child development, and they can have long-term impacts on socioeconomic outcomes in adulthood. This article summarizes the findings of a new study using Statistic Canada’s data and analyzes the...

An important aspect of the impact of COVID-19 is its disproportional impact across gender. This Insights article proposes a year-over-year approach that compares employment from March 2020 to February 2021 to their March-2019-to-February-2020 counterparts. It uses the Labour Force Survey to...

The COVID-19 pandemic has changed how production occurs in the economy in two ways. One is the full or partial closure of non-essential activities such as travel, hospitality, arts and entertainment, personal services, airlines, etc. The other is the widespread shift from in-office work to...

This article uses data from a recent crowdsourcing data initiative to report on the employment and financial impacts of the COVID-19 pandemic on Indigenous participants. It also examines the extent to which Indigenous participants applied for and received federal income support to alleviate these...

The COVID-19 pandemic has highlighted the varying labour market experiences and outcomes of diverse groups of Canadians. To mark Asian Heritage Month, Statistics Canada is providing a profile of the employment characteristics of the three largest Asian populations in Canada: South Asian, Chinese...

April Labour Force Survey (LFS) data reflect labour market conditions during the week of...

The evolution of the wealth, assets and debts of various groups of Canadians since the late 1990s has been documented in several studies. Yet little is known about the evolution of the wealth holdings of unattached men and women aged 50 and older, who make up a large part of the population. This...

In 2019, non-profit organizations (NPOs)—serving households, businesses and governments—employed 2.5 million people, representing 12.8% of all jobs in Canada. The employment share ranged between 12.4% and 12.8%, increasing during the 2010-to-2019 period. While the economic and social...

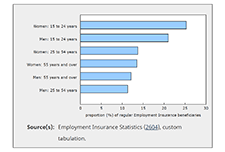

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and...

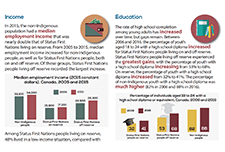

This is a custom report produced in collaboration between the Assembly of First Nations and Statistics Canada. It includes a variety of social and economic statistics for Status First Nations people living on and off reserve and includes comparisons with the non-Indigenous...

As stated in the Poverty Reduction Act, the Market Basket Measure (MBM) is now Canada’s Official Poverty Line. The Northern Market Basket Measure (MBM-N) is an adaptation of the MBM that reflects life and conditions in two of the territories – Yukon and Northwest TerritoriesNote. As with...

Given the scope and the diversity of the reports and studies that examined the impacts of the pandemic on well-being, it can be challenging to absorb and understand all the ways in which quality of life has been affected by COVID-19. The well-being literature offers an approach that may help. This...