Discover financial empowerment resources

Discover financial empowerment resources

This year marks the 35th anniversary since the passing of the unanimous all-party federal resolution to end child poverty in Canada by the year 2000. Using tax filer data from 2022, the latest available, this year’s report card found a troubling trend: child poverty increased at record rates two...

Enrolling in post-secondary education can be expensive. The Registered Education Savings Plan (RESP) is a dedicated savings plan designed to help you save for a child’s education after high school. Learn more about how RESPs work, the types of RESPs, and the fees involved by heading over to the...

In Canada and the United States, approximately 1 in 5 children live in poverty, contributing to poor health outcomes. Families with children with chronic illness may experience additional financial stress related to hospitalization. This study aimed to capture experiences of financial needs and...

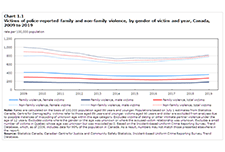

Gender-based violence (GBV) is one of the most prevalent human rights issues in the world. Worldwide, an estimated one in three women will experience physical or sexual abuse in her lifetime. GBV is a multifaceted issue that undermines the health, dignity, security and autonomy of women and has a...

The Expanding Economic Opportunity Through Volunteer Income Tax Assistance (EEOVITA) cohort has been working to identify and engage targeted, underserved populations most at risk for missing out on the expanded Child Tax Credit (CTC) benefit. This project, which began in January 2022 and concludes...

In 2014, the government of BC declared October RDSP Awareness Month to help raise awareness about the Registered Disability Savings Plan (RDSP). The RDSP is the world’s first savings plan specifically designed for people with disabilities. Even with little to no personal contributions, there are...

For some individuals with a disability, the main labour market challenge is to find employment. Others may find it difficult to retain their jobs or qualify for promotion opportunities. This study offers important new insights into the life-long evolution of the earnings of individuals whose...

This infographic by community food centres Canada provides a helpful visual summary of tax benefits that can add to income or reduce the taxes Canadians pay when they file their tax return. The information is especially useful for people: Working or living on a low income; Living with a...

Make it Count is a parent's resource for youth money management provided by the Manitoba Securities Commission that provides activities and tips to help you incorporate youth money management lessons into your daily routine. You can easily turn errands into education. Disponible en...

Brought to you from CPA Canada, this financial literacy podcast talks about key issues, trends and tips as they relate to financial education. Season 7 of the Mastering Money podcast takes a deep dive into debt and the way it affects Canadians. Season 6 of the Mastering Money podcast will help...

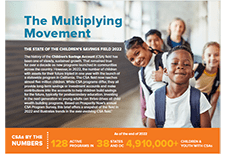

The Multiplying Movement: The State of the Children’s Savings Field 2022 shares findings from Prosperity Now’s 2022 Children’s Savings Account (CSA) program survey. The report highlights the incredible growth of the field with over 4.9 million children and youth with CSAs across the US. In...

Food insecurity – inadequate or uncertain access to food because of financial constraints – is a serious public health problem in Canada, and all indications are that the problem is getting worse. Drawing on data for 103,500 households from Statistics Canada’s Canadian Community Health...

Last year, the expanded Child Tax Credit (CTC) helped to lift nearly four million children out of poverty and provided economic relief to millions of struggling households. However, many first-time and lapsed filers from underserved and vulnerable populations missed out on these critical benefits....

A toolkit for parents/caregivers with a child with a disability ages 2 to 10, containing: An everyday childhood action guide Early planning priorities for parents with a child with a disability (upcoming webcast) Accessing financial resources for a young child with a disability (upcoming...

The financial resources available to families with young children are an important factor affecting child development, and they can have long-term impacts on socioeconomic outcomes in adulthood. This article summarizes the findings of a new study using Statistic Canada’s data and analyzes the...

The most recent 2018 data from the Longitudinal Immigration Database (IMDB) indicate that immigrant children make a significant contribution to Canadian society and the Canadian economy over time. Although immigrant children (32.2%) are more than twice as likely as non-immigrant children (15.4%)...

Family violence in Canada: A statistical profile is an annual report produced by the Canadian Centre for Justice and Community Safety Statistics at Statistics Canada as part of the Federal Family Violence Initiative. Since 1998, this report has provided data on the nature and extent of family...

The 2020 State of the Child Report includes six recommendations and gives a snapshot of some of the challenges New Brunswick children and youth will have to overcome as the province moves forward and juggles the new realities of public health measures to prevent the spread of COVID-19 while...

This report's release was part of Child Rights Education Week and also in celebration of the 30th anniversary of the United Nations Convention on the Rights of the Child (UNCRC). 2019 was declared the International Year of Indigenous Languages by the United Nations. The report contains an overview...

The infographic "Intergenerational income mobility: The lasting effects of growing up in a lower-income family" based on the article "Exploration of the role of education in intergenerational income mobility in Canada: Evidence from the Longitudinal and International Study of Adults," published in...

Launched by the Centre for Gender, Diversity and Inclusion Statistics (CGDIS), the Gender, Diversity and Inclusion Hub focuses on disaggregated data by gender and other identities to support evidence-based policy development and decision...

This study examines the affect that an increase in household income, due to a government transfer unrelated to household characteristics, has on children's long-term outcomes. It is found that increased income increases children's educational...

This study provides disaggregated statistics on the socioeconomic outcomes of the Black population by generation status (and immigrant status), sex and country of origin, and is intended to illustrate and contribute to the relevance of disaggregation in understanding these populations and the...

This report presents an analysis of the impact of COVID-19 on the nonprofit sector drawn from data collected in CCVO's Alberta Nonprofit Survey, data from surveys by the Alberta Nonprofit Network, Imagine Canada, and partner organizations across the country. The analysis in this report shows that...

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill...