Discover financial empowerment resources

Discover financial empowerment resources

This report is about the barriers low-income individuals face when filing taxes in Canada and how these obstacles prevent them from accessing critical government benefits. It focuses on the experiences of food bank clients, highlighting both the personal and systemic challenges they encounter, and...

Your tax notice of assessment tells you many important things. Learn more about what’s in your notice of assessment and what to do if you need to make a change on your tax return or if you disagree with your assessment. Available in...

Seeking help on tax filing and accessing benefits in Manitoba? Click on 'Access this resource' to visit the Community Financial Counselling Services website for more...

Many Canadians assume that poverty among seniors is a minor issue. That the income security system provides enough for the elderly to live with dignity. But this new report reveals a different reality: 430,000 seniors in Canada live below the Official Poverty Line. Why does seniors’ poverty...

No matter where you are in your financial journey—whether you’re beginning your career, saving for your children’s education, planning for retirement, or setting up a legacy for your loved ones—working with a qualified Financial Planner to create a financial plan can significantly help in...

The CRA has put together a website for what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. This includes information on tax exemption and who is eligible. There is also information on...

The CRA has launched taxology podcasts. These weekly informal sessions address different topics whether you’re starting your first job, doing your first return, or need a refresher on the basics. CRA hosts talk to experts to share tips and answer top questions to help listeners understand the...

The Embedded Financial Coaching project builds on evidence that embedding financial coaching into employment services leads to stronger employment and financial well-being outcomes. This report provides insights on the project components including delivering financial coaching services, developing...

This infographic provides a helpful visual summary of tax benefits that can add to income or reduce the taxes people in Canada pay when they file their tax return. The information is especially useful for people in Canada who: Are working or living on a low income; Live with a...

The Working Centre in Kitchener-Waterloo has been dedicated to aiding marginalized populations for over 40 years. In partnership with Prosper Canada, it embarked on an initiative to connect the populations they serve to government benefits and tax filing support. Recognizing the intricate...

The CRA's Indigenous strategy takes inspiration from the United Nations Declarations on the Rights of Indigenous Peoples and contributes to the Government of Canada’s efforts to advance reconciliation. It presents an integrated approach to improve trust and ensure that our services are...

Interpreting the data: Key takeaways from Welfare in Canada, 2023. For nearly 40 years, the annual Welfare in Canada series and its predecessors have documented the depth of poverty that persists for people receiving social assistance. The 2023 edition builds on this work to provide a...

The Welfare in Canada reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and...

In November 2023, Prosper Canada hosted two national, virtual roundtable sessions on closing the gap in tax filing and improving benefits access for under-served populations. The roundtables brought together more than 50 participants from government, industry, and community organizations to start a...

Filing a tax return is one of the most important ways for Canadians to access income benefits. However, numerous barriers can make tax filing challenging, particularly for people living on low incomes. After engaging with 31 individuals, we discovered that there are disruptors and compounders that...

The disability tax credit (DTC) is an important program for those facing severe and prolonged physical or mental impairment. Some individuals face unique barriers when it comes to completing their application and claiming the credit. On this page, the CRA is correcting some of the most common myths...

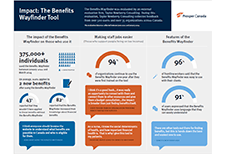

The external evaluation firm, Taylor Newberry Consulting, evaluated the Benefits Wayfinder between June 2022 and January 2024. This infographic showcases the feedback received based on feedback collected from 500 users and over 35 organizations across Canada. Impact: L'orienteur en mesures...

This article by Credit Canada answers many questions around tax filing. For instance, what happens if you don't file your taxes, or you don't pay any tax owing. It also addresses the benefits of filing your taxes. Click on "Access this resource" to learn...

This CRA site has information on what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. There's also information on available tax filing...

Every year, scammers take advantage of income tax filing season to try to trick Canadians into divulging sensitive personal information that scammers can use to commit fraud or into sending money to pay off fictitious "debts". How to spot most tax season scams There are often red flags that the...

The Canada Disability Benefit is an opportunity to guarantee that people with disabilities can live a life with dignity and have an adequate standard of living. For the new Canada Disability Benefit (CDB) to meet its goal of financially supporting and reducing poverty of people with disabilities,...

This publication is an outreach product to help promote the program "How to open a Registered Disability Savings Plan (RDSP) for yourself or a loved one with a disability". This infographic was created in response to feedback from stakeholders and was designed in collaboration with experts in...

This report provides insights from the project, including highlighting the challenges people with disabilities in British Columbia face in their journey to get income benefits, the opportunities to remove those barriers and implications for future benefits design. The demand for access to benefits...

The overall purpose of the collaborative project between Seneca College and Prosper Canada was to build a supportive booking system for tax clinics serving low-income...

The Expanding Economic Opportunity Through Volunteer Income Tax Assistance (EEOVITA) cohort has been working to identify and engage targeted, underserved populations most at risk for missing out on the expanded Child Tax Credit (CTC) benefit. This project, which began in January 2022 and concludes...