Discover financial empowerment resources

Discover financial empowerment resources

The Financial Consumer Agency of Canada’s (FCAC) report examines and compares key measures of financial well-being for 3 groups of Canadians: homeowners with mortgages, homeowners without mortgages, and renters. The data shown here are derived from FCAC’s COVID-19 Financial Well-being Survey....

Home ownership may be the biggest investment you’ll ever make, so it’s important to take your time. This resource by the Canadian Bankers Association outlines the types of mortgages, interest rate considerations, mortgage loan insurance, qualifying for a mortgage, renewing a mortgage and...

Under the Mortgage Brokerages, Lenders and Administrators Act, 2006 (MBLAA) all individuals and businesses in Ontario who carry out regulated mortgage brokering activities must be licensed with the Financial Services Regulatory Authority unless otherwise exempted by the Act. As regulator, their...

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

On August 5, 2024, FCAC relaunched its national, multi-media advertising campaign titled “Housing Costs on Your Mind?”. The campaign promotes FCAC’s tools and resources related to renting, buying a home and owning a home with a mortgage. The campaign runs until...

Struggling to pay your mortgage? FCAC expects federally regulated financial institutions to help you if you're struggling to pay your mortgage due to exceptional circumstances. Learn more about paying your mortgage when experiencing financial...

Fast facts: More than 99 per cent of Canadians have a bank account 31 per cent of Canadians say they pay no service fees at all and another 45 per cent pay $15 or less per month Canadians are careful borrowers. Only 0.17 per cent of mortgages are in arrears Access this resource to read...

Economies around the world have had some rough years recently. From a global pandemic, a bout of inflation, a disruption in supply chains, coping with a European war and ongoing concern about global financial stability. The Canadian economy has weathered these storms as well, if not better than...

In Canada, laws and regulations protect financial consumers, ensuring they are treated fairly and have access to essential banking services. These rules prioritize helping people achieve better financial outcomes, especially concerning homeownership and mortgage difficulties. The Canada Mortgage...

Recent increases in the cost of living and declining real estate values had unprecedented impacts on net saving and wealth for more financially vulnerable households in the first quarter, such as those with lower incomes, less wealth, and in younger age groups. Statistics Canada has gathered data...

While your credit score is a number to quickly show how creditworthy you are, your credit report is more detailed. It covers your entire credit profile and includes information such as personal information, credit account (including credit cards, lines of credit, mortgages...),...

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning...

Take this self-assessment quiz to figure out how your financial literacy skills and knowledge measure up compared to other...

The Thriving or Surviving study uncovers the kitchen table issues that confront Canadians daily, revealing how the country is coping with concerns such as debt, savings, emergency funds and financial...

This report examines the financial health and vulnerability of households in Canada’s 35 largest cities, using a new composite index of household financial health at the neighbourhood level, the Neighbourhood Financial Health Index or NFHI. The NFHI is designed to shine a light on the dynamics...

For many, homeownership is a vital part of the American dream. Buying a home represents one of the largest lifetime expenditures for most homeowners, and the mortgage has generally become the financing instrument of choice. For many families, their mortgage will be their greatest debt and their...

Using data from the Survey of Financial Security (SFS), this article looks at changes in debt, assets and net worth among senior Canadian families over the period from 1999 to 2016. It also examines changes in the debt-to income ratio and the debt to-asset ratio of senior families with debt. This...

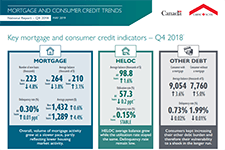

The Canada Mortgage and Housing Corporation (CMHC) publishes a quarterly report on Canadian trends relating to mortgage debt and consumer borrowing. Find out the level of Canadian household indebtedness, and emerging trends in outstanding debt balances in different urban areas and by age...

This calculator from the Financial Consumer Agency of Canada determines your mortgage payment and provides you with a mortgage payment...

This is a guide from the FCAC on variable interest rate mortgages in Canada. A variable interest rate mortgage is a mortgage loan with an interest rate that can change during the term. The interest rate varies with changes in market interest rates (typically the bank’s prime lending rate). The...

This is a guide from the FCAC on shopping around for a mortgage. A mortgage is a loan that is designed to help you purchase a home or other property. Home buyers make a down payment on the purchase price and then borrow the remainder from a lender. Five percent is the minimum down payment home...

When you bought your home, you probably signed a mortgage agreement that remains in effect for a certain period, called the term . When your mortgage term comes to an end, you will have to pay off your mortgage, renew it for another term or switch your mortgage to another lender. Your options are...

Mortgage prepayment refers to paying more than the regular mortgage payments you have agreed to pay in your mortgage contract. If your mortgage gives you prepayment privileges, you can save thousands of dollars in interest charges by paying down your mortgage faster. However, if you have a closed...

You have choices that can help you pay off your mortgage faster and save a lot of money in interest charges. It all starts with understanding how your payment is applied to the principal and interest you owe, and the options your mortgage lender can offer...

Buying a home is probably the biggest financial decision you will ever make, and for most people, it requires getting a mortgage. Before you start shopping around, you need to know what you can afford. It’s important to have a realistic budget. This publication outlines three steps you can take...