Discover financial empowerment resources

Discover financial empowerment resources

There are rules about how much money a person living on Ontario Works can receive in gifts or “voluntary payments”. Generally, a person living on Ontario Works can receive gifts up to a maximum of $10,000 in a 12-month period. There are rules around reporting gifts, and decisions on how to...

This brief discusses the savings penalties in public assistance programs in the United States, also known as asset limits, and that actions that can be taken to eliminate these limits and the barriers towards building savings for families living on low...

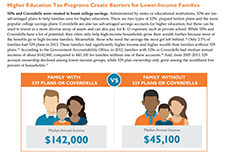

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and...

There was a time, not very long ago, when Canadians were savers. In 1982, we routinely set aside 20 percent of our yearly income for large household purchases, education, starting businesses, retirement or just plain rainy days. Having a savings ‘nest egg’ was accepted wisdom and the norm. Then...

Focus on Native Communities provides information and tools to help you meaningfully connect Your Money, Your Goals to the community members you serve. T his guide—Your Money, Your Goals: Focus on Native Communities—contains additional information, tips, and tools based on the wisdom of tribal...

These are the webinar slides from the CFED webinar on asset limits and savings possibilities for Americans on social assistance. The webinar highlights findings from 3 research studies that explore asset limits and household financial security; discusses policy changes to asset limits and their...

Many public benefit programs – such as cash welfare and Medicaid – limit eligibility to those with few or no assets. If individuals or families have assets exceeding the state’s limit, they must “spend down” longer-term savings in order to receive what is often short-term public...

Many public benefit programs discourage family savings. Asset limits in TANF, SNAP, LIHEAP and SSI limit eligibility to those with very little in savings. Asset limits get it backwards. Public benefits help families get by; savings help them get ahead. Personal savings are precisely the kind of...

To qualify for TANF and SNAP, families in many states must prove, among other criteria, that their income and assets do not exceed state or federal levels. These asset limits are caps on the amount of cash, savings, or material property that a family can hold when applying. In the case of TANF,...