Discover financial empowerment resources

Discover financial empowerment resources

The affordable housing crisis in Canada creates many challenges for millions of people trying to find a place to live that they can afford. For many marginalized renters, discrimination presents additional barriers making it even harder for them to find a home. To better understand these...

From 2019 to 2022, among Indigenous people aged 18 years and older, 54.3% of Inuit reported having a regular healthcare provider, along with 81.4% of First Nations people living off reserve and 84.5% of Métis. This is compared with 85.7% of the non-Indigenous adult population. Released...

Tables for 14 indicators in Canada's Quality of Life Framework have been updated to include Canadian Social Survey data collected from October to December 2024 (fourth quarter of 2024). These indicators include life satisfaction, sense of meaning and purpose, future outlook, loneliness,...

The COVID-19 pandemic and post-pandemic recovery were “feast and famine” for the budgets of low-income families and individuals across Canada. Because of the income support programs put in place to help Canadians affected by workplace shutdowns, the poverty rate fell to 6.4% in 2020, down by...

The Financial Consumer Agency of Canada’s (FCAC) report examines and compares key measures of financial well-being for 3 groups of Canadians: homeowners with mortgages, homeowners without mortgages, and renters. The data shown here are derived from FCAC’s COVID-19 Financial Well-being Survey....

Women and girls are highlighted within Canada’s National Financial Literacy Strategy as a diverse population that can benefit from tailored approaches to strengthen financial resilience. To help close the gender gap, the Financial Consumer Agency of Canada (FCAC) developed and tested the benefits...

In 2023, the Financial Consumer Agency of Canada (FCAC) and researchers from Carleton University developed and tested the effectiveness of brief, online interventions at improving the financial confidence, financial knowledge and positive financial behaviours of young women ages 16–25. To...

The findings in this report highlight the important role of Old Age Security in reducing poverty, with payments under this program making up a large share of annual income for older adults in Toronto’s lowest income deciles. However, too many eligible older adults in Toronto are not receiving OAS...

In partnership, Daily Bread Food Bank and North York Harvest Food Bank have released Who’s Hungry 2024 – an annual profile of poverty and food insecurity in the City of Toronto. In the last year, there were 3.49 million client visits to Toronto food banks – nearly 1 million more visits...

One of the core strategic priorities identified in FAIR Canada's 2023 -2028 Strategic Plan was to conduct and share research that provides deeper perspectives directly from individual investors about key policy matters that have an impact on them. As part of this effort, FAIR Canada commissioned an...

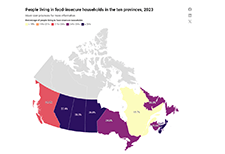

In 2023, 22.9% of people in the ten provinces lived in a food-insecure household. That amounts to 8.7 million people, including 2.1 million children, living in households that struggled to afford the food they need. With another year of rising food insecurity, the percentage of people affected is...

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...

The annual BBB Scam Tracker Risk Report report analyzes data that individuals and businesses submitted to BBB Scam TrackerSM (BBB.org/ScamTracker) in 2023. The findings shed light on how scams are perpetrated, who is being targeted, which scams have the greatest impact, and which behaviors and...

Rental apartment supply increased, but it has not kept up with the growing demand. As a result, vacancy rates have reached record lows while rent prices have soared to record highs. This situation has raised major concerns about the affordability of rental housing. Read the rental market...

The Government of Canada has put together statistics highlighting sociodemographic diversity, educational attainment, labour market participation and business ownership and income and inequality for Black History...

Longevity literacy is an understanding of how long people tend to live upon reaching retirement age. It is particularly important since retirement income security requires planning, saving, and preparing for a period that is uncertain in length. This matters because longevity literacy is...

Working poverty is pervasive, racialized, and until the pandemic, was increasing in Toronto and across Canada. Until the pandemic, this increase was counterintuitive, during 2006 to 2016, as most of this ten-year period had been characterized by one of the most prolonged economic recoveries in...

This is a custom report produced by Statistics Canada in collaboration with the Assembly of First Nations. It includes key social and economic statistics regarding Status First Nations people living on and off reserve and includes comparisons with the non-Indigenous...

The combination of the COVID-19 pandemic, social unrest, and a severely distressed economy poses a real and significant crisis to an already fragile safety net for the 1.2 million people that comprise Canada’s diverse Black communities. The aim of this report is to provide a systematic analysis...

As cash use, access, and acceptance declines in Canada, vulnerable demographics are at risk of being left behind. For many, cash is more than just a method of payment. The growing pattern of electronic payments means that cash could become more scarce, threatening those who rely on it. While a...

Two articles released in Economic and Social Reports provide insights on the poverty rates and changing demographics of racialized population groups in Canada. The article "Poverty among racialized groups across generations," shows that most racialized groups had higher poverty rates...

Drawing on survey and interview data, as well as data from Daily Bread and North York Harvest’s member agencies, the 2022 Who’s Hungry report examines trends in food bank use and food insecurity over the past year in relation to three core areas: income and employment, housing, and the cost of...

This Financial Resilience Institute report, authored by Eloise Duncan and commissioned by FP Canada and the Institut québécois de planification financière (IQPF) is being published for everyone with a stake in the financial resilience and well-being of Canadians. This study, leveraging the...

Employment and income experiences for persons with disabilities often differ from persons without disabilities. Barriers to accessibility within these areas often lead to lower employment rates and decreased income levels for persons with disabilities, in relation to persons without...

The Financial Consumer Agency of Canada’s (FCAC) COVID-19 Financial Well-being Survey, which began in August 2020, is a nationally representative hybrid online-phone survey fielded monthly, with approximately 1,000 respondents per month. The survey collects information on Canadians’ day-to-day...