Discover financial empowerment resources

Discover financial empowerment resources

Rising housing costs have had an impact on the ability of families to move. This article, using data from the Canadian Social Survey (CSS), illustrates how higher prices have disproportionately affected the moving decisions of young Canadians, particularly those experiencing financial...

The Financial Consumer Agency of Canada’s (FCAC) report examines and compares key measures of financial well-being for 3 groups of Canadians: homeowners with mortgages, homeowners without mortgages, and renters. The data shown here are derived from FCAC’s COVID-19 Financial Well-being Survey....

Home ownership may be the biggest investment you’ll ever make, so it’s important to take your time. This resource by the Canadian Bankers Association outlines the types of mortgages, interest rate considerations, mortgage loan insurance, qualifying for a mortgage, renewing a mortgage and...

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

Among the truly urgent crises facing the United States is widespread household financial insecurity. A stunning 51% of U.S. households have expenses that are at least equal to—if not greater than—their income, and 55% lack the necessary savings to weather a simultaneous income drop and expense...

Shared equity homeownership is a self-sustaining subsidy model for achieving affordable homeownership. Stable and affordable homeownership is an important way to build long-term wealth, increase a sense of agency, and create a path to economic security for individuals, communities, and future...

On August 5, 2024, FCAC relaunched its national, multi-media advertising campaign titled “Housing Costs on Your Mind?”. The campaign promotes FCAC’s tools and resources related to renting, buying a home and owning a home with a mortgage. The campaign runs until...

Struggling to pay your mortgage? FCAC expects federally regulated financial institutions to help you if you're struggling to pay your mortgage due to exceptional circumstances. Learn more about paying your mortgage when experiencing financial...

Greater attention has been given in recent years to the role of parental wealth in the home ownership aspirations of younger Canadians. Just as the intergenerational transmission of income inequality is of concern, an increasing reliance on the "Bank of Mom and Dad" raises questions about how...

Economies around the world have had some rough years recently. From a global pandemic, a bout of inflation, a disruption in supply chains, coping with a European war and ongoing concern about global financial stability. The Canadian economy has weathered these storms as well, if not better than...

The Housing Supply Report provides regular insights on new housing supply in Canada’s major cities and urban areas. These insights can help us understand the supply responsiveness that we know contributes to price escalation and housing affordability challenges. This report examines new housing...

In Canada, laws and regulations protect financial consumers, ensuring they are treated fairly and have access to essential banking services. These rules prioritize helping people achieve better financial outcomes, especially concerning homeownership and mortgage difficulties. The Canada Mortgage...

Widespread household financial insecurity is an undeniably urgent crisis in the United States today. A stunning 51 percent of U.S. households have expenses that are equal to or greater than their income, and 55 percent lack the necessary savings to weather a simultaneous income drop and expense...

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular...

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to...

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the...

For many, homeownership is a vital part of the American dream. Buying a home represents one of the largest lifetime expenditures for most homeowners, and the mortgage has generally become the financing instrument of choice. For many families, their mortgage will be their greatest debt and their...

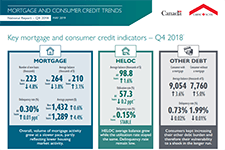

The Canada Mortgage and Housing Corporation (CMHC) publishes a quarterly report on Canadian trends relating to mortgage debt and consumer borrowing. Find out the level of Canadian household indebtedness, and emerging trends in outstanding debt balances in different urban areas and by age...

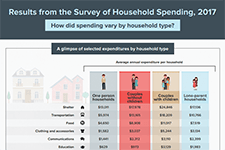

This infographic from Statistics Canada summarizes the results of the Survey of Household Spending, 2017, including average annual expenditures by household...

This Economic Insights article quantifies the degree to which families who expect their financial situation to get better in the next two years have, all else equal, more debt than comparable families. The study shows that even after a large set of socioeconomic characteristics is controlled for,...

This calculator from the Financial Consumer Agency of Canada determines your mortgage payment and provides you with a mortgage payment...

This report is the second of two complementary reports that address the issue of economic security for Indiana households. The Self-Sufficiency Standard approach to economic security consists of three elements: securing the costs of daily basic needs, creating an emergency savings fund, and...

The following profile presents data on the economic inequalities within Miami. These statistics may seem overwhelming. However, we with more information about the challenges of racial economic inequality, there is greater opportunity to identify best practices and policies that can address the...

The following profile presents data on the economic inequalities within New Orleans. These statistics may seem overwhelming. However, we know with more information about the challenges of racial economic inequality, there is greater opportunity to identify best practices and policies that can...

This is a guide from the FCAC on shopping around for a mortgage. A mortgage is a loan that is designed to help you purchase a home or other property. Home buyers make a down payment on the purchase price and then borrow the remainder from a lender. Five percent is the minimum down payment home...