Discover financial empowerment resources

Discover financial empowerment resources

Longevity literacy is an understanding of how long people tend to live upon reaching retirement age. It is particularly important since retirement income security requires planning, saving, and preparing for a period that is uncertain in length. This matters because longevity literacy is...

This presentation at the Canadian Economics Association by Professor Annamaria Lusardi, looks at how we measure financial literacy, how we measure the impact of financial literacy on behaviour, how this data and these findings may be used to design policy and programs and what the implications for...

Six years of data from the TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) clearly demonstrate that U.S. adults with greater financial literacy tend to have better financial well-being. This report shows that retirement readiness, a specific realm of financial well-being, likewise tends...

The economic impact of the COVID-19 crisis has brought to light the deeply rooted financial struggles that many Americans face. This paper shows that even before the pandemic, a substantial share of households was already anxious and stressed about their personal finances. The greatest levels of...

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) measures knowledge and understanding that enable sound financial decision making and effective management of personal finances among U.S. adults. The P-Fin Index is an annual survey developed by the TIAA Institute and the Global...

Women are less financially literate than men. It is unclear whether this gap reflects a lack of knowledge or, rather, a lack of confidence. This survey experiment shows that women tend to disproportionately respond “do not know” to questions measuring financial knowledge, but when this response...

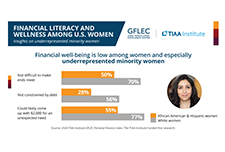

This paper provides an in-depth examination of the financial well-being of Black and Hispanic women and the factors contributing to it, using the 2018 wave of the National Financial Capability Study. Differences between Black and Hispanic women versus White women are documented, in that the former...

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined...

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed...

This paper introduces a novel survey measure of attitude toward debt. Survey results with panel data on Swedish household balance sheets from registry data are matched, showing that debt attitude measure helps explain individual variation in indebtedness as well as debt build-up and spending...

This study presents findings from a measurement of financial literacy using questions assessing basic knowledge of four fundamental concepts in financial decision making: knowledge of interest rates, interest compounding, inflation, and risk diversification. Worldwide, just one in three adults are...

Research shows that many people make poor economic decisions because they are financially illiterate. As we show here, financial ignorance can be expensive and even ruinous, for many. Our goal in this article is to provide an overview of existing work in this important field. We also provide new...

The authors developed and experimentally evaluated four novel educational programs delivered online: an informational brochure, a visual interactive tool, a written narrative, and a video narrative. The programs were designed to inform people about risk diversification an essential concept for...

This paper examines households’ financial fragility by looking at their capacity to come up with $2,000 in 30 days. Using data from the 2009 TNS Global Economic Crisis survey, the respondents who report being certain or probably not able to cope with an ordinary financial shock of this size...

The Standard & Poor's Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey...