Discover financial empowerment resources

Discover financial empowerment resources

Wealth inequality, health and health equity is one in a series of ongoing think pieces from Wellesley Institute that aim to stimulate ideas and new conversations to create a fairer and healthier tomorrow. Canadians are struggling with the rising cost of living. A national survey in November 2023...

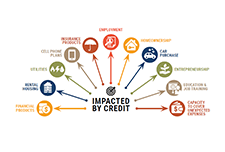

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that...

Recover and Rebuild: Helping Canadians build financial security during the pandemic and beyond The 2021 ABLE Financial Empowerment (FE) virtual series is a collection of online financial empowerment events designed to provide frontline FE practitioners, FE stakeholders, policy-makers and...

Given the scope and the diversity of the reports and studies that examined the impacts of the pandemic on well-being, it can be challenging to absorb and understand all the ways in which quality of life has been affected by COVID-19. The well-being literature offers an approach that may help. This...

As stated in the Poverty Reduction Act, the Market Basket Measure (MBM) is now Canada’s Official Poverty Line. The Northern Market Basket Measure (MBM-N) is an adaptation of the MBM that reflects life and conditions in two of the territories – Yukon and Northwest TerritoriesNote. As with...

This paper discusses the concept of disposable income used in the MBM. Disposable income is a measure of the means available to a Canadian family to meet its basic needs and achieve a modest standard of living. The disposable income of families surveyed in the Canadian Income Survey (CIS) is...

The Who’s Hungry Report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto. To create the reports, trained volunteers conduct face-to-face interviews with over 1,400 food bank clients at nearly 40 member agencies, collecting demographic data as well...

This report examines the relationship between the earnings of Canadians in the labour market and their post-secondary education credentials. Findings are based upon information gathered from the 2016 Census on adults between the ages of 25 to 64 with different levels of education and working in...

This review looks at the activities, impact, and drivers and barriers to success of four types of community-led approaches: voluntary action, community organising, social action and community economic...

After more than a year of dedicated research, analysis, and outreach, CFSI has developed eight indicators to measure financial health. For each indicator, we provide benchmarks, financial data proxies, survey question alternatives, and data sources, among other things. This is the final report on...

In recent years, there has been growing academic and media attention regarding income inequality—the disparity in the distribution of income across households. This report focuses on a less studied issue, how income varies within households even over relatively short periods of time....

Millions of small-dollar credit borrowers are set back by predatory lending practices. There is a critical need for high-quality products designed for both borrower success and lender profitability. This report shares an analysis of practices of 16 installment lenders that have adopted some of the...

The Local Initiative Support Corporation (LISC) developed the strategy Building Sustainable Communities to tackle pressing need through an expansive network of Financial Opportunity Centers (FOCs) in dozens of communities nationwide. FOCs help clients find and maintain good jobs, stick to realistic...

As a greater share of modern life is encoded into data streams, Big Data tools can enhance the capabilities of a wide range of financial service companies through machine-learning algorithms that get smarter over time, building stronger predictive models as they gather customers and data points....