Discover financial empowerment resources

Discover financial empowerment resources

The financial resilience and financial well-being of Canadians with low incomes: Insights and analysis to support the financial empowerment sector detailed report, provides data and insights on the financial impact of the pandemic on Canadians with low incomes and their financial health, resilience...

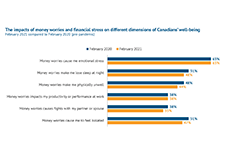

This brief discusses how more financially vulnerable Canadians are most challenged based on the Seymour Financial Resilience Index TM. This E-Brief builds on Statistics Canada Canadians' Well-being in Year One of the COVID-19 Pandemic report and Seymour’s February 2021 Index Release...

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from...