Discover financial empowerment resources

Discover financial empowerment resources

Money Matters is a free introductory financial literacy program for adult learners that has been delivered to Canadians since 2011 and has reached over 80,000 adults. It was developed by ABC Life Literacy Canada in partnership with the Government of Canada and TD Bank Group and was designed by...

The ability to build assets allows an individual or family to meet long-term financial goals and create economic stability for the future. This toolkit contains resources on goal setting, action planning and information on financial products and government supports that can help with building...

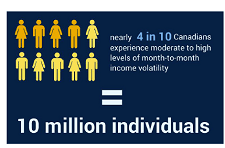

In this video presentation Derek Burleton of TD Economics shares findings from the report 'Pervasive and Profound,' which examines income volatility trends in Canada. The survey found that nearly 40% of Canadians experience moderate to high income volatility. This presentation was given at the...

A growing number of Canadians are living with fluctuating incomes - incomes which may vary significantly from month to month, not just from year to year. This makes it difficult to save, plan, and achieve financial wellness. This webinar, "Income volatility in Canada: Why it matters and what to do...

Income volatility describes income which is inconsistent (not received on a regular and predictable basis), unstable (amount varies each time it is received), and that fluctuates month to month by a significant percentage. TD’s report, Pervasive and Profound, has found that Canadians...

Last year marked the seventh straight year of solid employment gains in Canada following the recession. But, scratching beneath the surface shows the credit went solely to part-time positions. Steep losses in energy-producing provinces are only partially to blame for the decline in full-time...

Moving to a new country is exciting, but there's no denying that it comes with its own unique set of challenges. This infographic shows results from the Money Talk For Newcomers Poll by TD Canada...

We define precarious employment as having an outsized level of uncertainty, whether in terms of pay, ongoing employment, scheduling, or other dimensions. Types of work associated with precarious employment are typically lower paying, with an income gap of between $11,600 and $18,000 in 2014...

While the recession may technically draw to a close in the third quarter, its reverberations will be felt for some time. Most notably, recovery will be sluggish relative to that in the wake of past recessions. Unemployment will continue to rise into 2010 as re-hiring proceeds slowly and more...

The cost of obtaining a post-secondary education has risen rapidly over the last decade, and that price tag is likely to continue to rise faster than the price of inflation. Numerous academic studies show that the higher future income stream resulting from the investment in a post-secondary...

The Standard & Poor's Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey...