Guidance on digital delivery of financial education

Innovative uses of digital technologies in the delivery of financial education can serve multiple complementary objectives and effectively support the building blocks of financial education. This Guidance was developed to assist policy makers in deciding when to adopt digital delivery, and how to effectively design and implement digital financial education initiatives, by offering non-binding actionable directions. It builds on the work undertaken by the OECD and its International Network on Financial Education, including the G20/OECD-INFE Policy Guidance Note on Digitalisation and Financial Literacy and international comparative analyses on how public authorities design, deliver and evaluate digital financial education initiatives, notably in the context of the COVID-19 pandemic. The report on digital delivery of financial education design and practice builds on over 70 case studies from members of the OECD International Network on Financial Education, contributes to a better understanding of how public authorities worldwide are designing, delivering and evaluating digital financial education initiatives, and prepares forthcoming work on the development of high-level international guidance on the digital delivery of financial education.

Financial Consumer Protection responses to COVID-19

This policy brief provides recommendations that can assist policy makers in their consideration of appropriate measures to help financial consumers, depending on the contexts and circumstances of individual jurisdictions, during the COVID-19 crisis. These options are consistent with the G20/OECD High Level Principles on Financial Consumer Protection that set out the foundations for a comprehensive financial consumer protection framework.

Supporting the financial resilience of citizens throughout the COVID-19 crisis

This policy brief outlines initial the measures that policy makers can make to increase citizen awareness about effective means of mitigation for the impact of the COVID-19 pandemic and its potential consequences on their financial resilience and well-being.

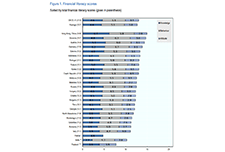

Launch of the OECD/INFE 2020 International Survey of Adult Financial Literacy

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018 OECD/INFE toolkit to collect cross-comparable data. The survey results report the overall financial literacy scores, as computed following the OECD/INFE methodology and definition, and their elements of knowledge, behaviour, and attitudes. The data used in this report are drawn from national surveys undertaken using and submitted to the OECD as part of a co-ordinated measurement exercise; as well as data gathered as part of the OECD/INFE Technical Assistance Project for Financial Education in South East Europe.

National Strategies for Financial Education: OECD/INFE Policy Handbook

Financial education has become an important complement to market conduct and prudential regulation and improving individual financial behaviours a long-term policy priority in many countries. The OECD and its International Network on Financial Education (INFE) conducts research and develops tools to support policy makers and public authorities to design and implement national strategies for financial education. This handbook provides an overview of the status of national strategies worldwide, an analysis of relevant practices and case studies and identifies key lessons learnt. The policy handbook also includes a checklist for action, intended as a self-assessment tool for governments and public authorities.

G20/OECD INFE Core Competencies Framework on financial literacy for Adults (aged 18+)

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to inform the development of a national strategy on financial education, improve programme design, identify gaps in provision, and create assessment, measurement and evaluation tools.

OECD/INFE Report on Financial Education in APEC Economies: Policy and practice in a digital world

This report responds to a call made by APEC Finance Ministers at their 23rd Ministerial Meeting in Lima in 2016 to advance “the design and implementation of financial literacy policies building on the expertise and standards developed by the OECD International Network on Financial Education”. The findings illustrate that the majority of APEC economies are well-advanced in their efforts to collect relevant data, implement appropriate financial education policies, and address the remaining issues related to financial literacy, inclusion and consumer

protection. They are applying international best practices and making good use of available tools and resources to develop and refine strategic approaches and specific initiatives. However, there is still some way to go in ensuring that everyone living in an APEC

economy has the financial literacy that they need and concerns about financial fraud or abuse, the high complexity of financial services and the low financial literacy of specific population groups are driving policy interest in improving financial education.

Ageing and Financial Inclusion: 8 key steps to design a better future

The G20 Fukuoka Policy Priorities for Ageing and Financial Inclusion is jointly prepared by the GPFI and the OECD. The document identifies eight priorities to help policy makers, financial service providers, consumers and other actors in the real economy to identify and address the challenges associated with ageing populations and the global increase in longevity. They reflect policies and practices to improve the outcomes of both current generations of older people and future generations.

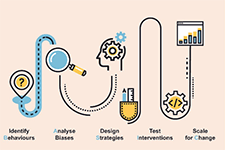

Tools and Ethics for Applied Behavioural Insights: The BASIC Toolkit

A better understanding of human behaviour can lead to better policies. If you are looking for a more data-driven and nuanced approach to policy making, then you should consider what actually drives the decisions and behaviours of citizens rather than relying on assumptions of how they should act. You can start applying behavioural insights (BI) to policy now. No matter where you are in the policy cycle, policies can be improved with BI through a process that looks at Behaviours, Analysis, Strategies, Interventions, Change (BASIC). This allows you to get to the root of the policy problem, gather evidence on what works, show your support for government innovation, and ultimately improve policy outcomes. This toolkit guides policy officials through these BASIC stages to start using an inductive and experimental approach for more effective policy making.

Core competencies frameworks on financial literacy

Developed in response to a call from G20 Leaders in 2013, the core competencies frameworks on financial literacy highlight a range of financial literacy outcomes that may be considered to be universally relevant or important for the financial well-being in everyday life of adults and youth. These documents describe the types of knowledge that youth aged 15 to 18, and adults aged 18 and up, could benefit from.