Benefits & credits: factsheets from the CRA

The CRA has compiled benefits and credits factsheets for: These are available in English and French.

Housing conditions among racialized groups: A brief overview

In response to Canada's Anti-Racism Strategy, Statistics Canada's Centre for Gender, Diversity and Inclusion Statistics is releasing a second set of five data tables on social inclusion. Over 20 new indicators, for a total of over 120 indicators, can now be used to examine various socioeconomic facets of racialized Canadians.

Tips to keep your credit card safe

Your credit card can help you make purchases quickly without needing to have cash on hand. Follow these tips by the Ontario Securities Commission to use your credit card safely.

Colour of Poverty – Colour of Change

There is a growing "colour-coded" inequity and disparity in Ontario that has resulted in an inequality of learning outcomes, of health status, of employment opportunity and income prospects, of life opportunities, and ultimately of life outcomes. Colour of Poverty-Colour of Change believes that it is only by working together that we can make the needed change for all of our shared benefit These fact sheets provide data to help understand the racialization of poverty in Ontario.

Questions and answers about filing your taxes

Questions and answers released by the Canada Revenue Agency (CRA) about filing your taxes, including information on:

Identity theft

Identity thieves try to use your personal information to take money from your bank account, shop with your credit card, or even commit crimes in your name. This publication explains how to spot the warning signs of identity theft, how to protect yourself, and what you can do if it happens to you.

Legal Resources Catalogue: Free legal information

This resource provides a list of free legal information resources produced by Community Legal Education Ontario (CLEO).

Canada Education Savings Program: Frequently Asked Questions

This fact sheet from the Government of Canada answers Frequently Asked Questions about the Canada Education Savings Plan. This includes details about the Canada Learning Bond, the Canada Education Savings Grant, and Registered Education Savings Plans (RESPs).

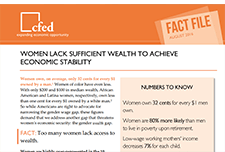

Fact File: Women Lack Sufficient Wealth to Achieve Economic Stability

Women own, on average, only 32 cents for every $1 owned by a man in America. Women of color have even less. Both the gender wage gap and the gender wealth gap need to be taken into account to address threats to women's economic security.

Financial Empowerment for Newcomers: Evaluation insights from pilot project

This fact sheet provides insights from Prosper Canada's Financial Empowerment for Newcomers pilot project conducted with three newcomer-serving organizations, Saskatoon Open Door Society (SODS), AXIS Employment Services (AXIS), and North York Community House (NYCH), who implemented and integrated financial coaching into their existing services for newcomers. The project objectives were to provide newcomer-serving front-line staff with training and resources to enable them to accurately assess newcomers’ financial literacy and connect them to appropriate information and resources and to coach newcomers to achieve successful financial independence.

It pays to plan for a child’s education

This fact sheet from ESDC explains how to open an RESP and access the Canada Learning Bond.

The Canada Learning Bond: What you need to know

This one-page fact sheet tells you everything you need to know to make your child's future possibilities grow! The Canada Learning Bond (CLB) is a grant of $500 up to $2000 from the Government of Canada to eligible families to help with the cost of a child’s education after high school. It is deposited directly into a child’s Registered Education Savings Plan (RESP). Children born January 1, 2004 or later, whose family’s annual income is less than $46,000 can receive the CLB.