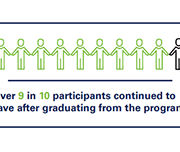

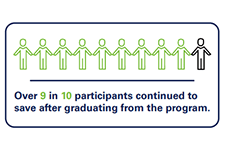

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

Prosperity Now Scorecard

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to jump-start a conversation about solutions and policies that put households on stronger financial footing across five issue areas: Financial Assets & Income, Businesses & Jobs, Homeownership & Housing, Health Care and Education.

Promise Accounts: Matched Savings to Help Families Get Ahead

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the racial wealth divide means creating saving pathways for low-income households to build wealth. Promise Accounts make some key changes to traditional matched savings programs. Specifically, these accounts would have features including:

Trading Equity for Liquidity: Bank Data on the Relationship Between Liquidity and Mortgage Default

For many, homeownership is a vital part of the American dream. Buying a home represents one of the largest lifetime expenditures for most homeowners, and the mortgage has generally become the financing instrument of choice. For many families, their mortgage will be their greatest debt and their mortgage payment will be their largest recurring monthly expense. In this report, we present a combination of new analysis and previous findings from the JPMorgan Chase Institute body of housing finance research to answer important questions about the role of liquidity, equity, income levels, and payment burden as determinants of mortgage default. Our analysis suggests that liquidity may have been a more important predictor of mortgage default than equity, income level, or payment burden.

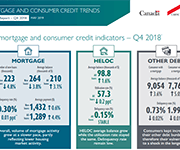

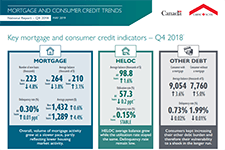

Mortgage and Consumer Credit Trends Report

The Canada Mortgage and Housing Corporation (CMHC) publishes a quarterly report on Canadian trends relating to mortgage debt and consumer borrowing. Find out the level of Canadian household indebtedness, and emerging trends in outstanding debt balances in different urban areas and by age group.

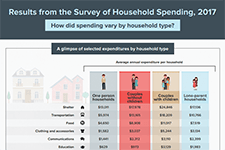

Results from the Survey of Household Spending, 2017 (Infographic)

This infographic from Statistics Canada summarizes the results of the Survey of Household Spending, 2017, including average annual expenditures by household type.

Financial Expectations and Household Debt

This Economic Insights article quantifies the degree to which families who expect their financial situation to get better in the next two years have, all else equal, more debt than comparable families. The study shows that even after a large set of socioeconomic characteristics is controlled for, families who expect their financial situation to improve in the near future have significantly more debt and generally higher debt-to-income ratios than other families.

Mortgage Calculator

This calculator from the Financial Consumer Agency of Canada determines your mortgage payment and provides you with a mortgage payment schedule.