The events of 2020 revealed unvarnished truths that demand that philanthropic organizations take action to build economic well-being for all. This long-overdue moment emphasizes the critical need for strategies that provide a range of support to women and Black, Latinx, Indigenous, and Asian people, who are struggling due to deep financial disparities. Today’s disparities are built on, and exacerbated by, long-standing inequities created by structural racism, sexism, and classism, which have limited financial security and overall well-being for those affected. This brief responds to the urgency of this moment, reimagining and building on past recommendations to map more just paths to economic resilience moving forward.

Annual report 2022

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 18 years, AFN has provided a forum for grantmakers to connect, collaborate, and collectively invest in helping more people achieve economic security. This report reflects their work over the past year working across 7 issues areas:

National Indigenous Economic Strategy 2022

This National Indigenous Economic Strategy for Canada is the blueprint to achieve the meaningful engagement and inclusion of Indigenous Peoples in the Canadian economy. It has been initiated and developed by a coalition of national Indigenous organizations and experts in the field of economic development. The Strategy is supported by four Strategic Pathways: People, Lands, Infrastructure, and Finance. Each pathway is further defined by a Vision that describes the desired outcomes for the actions and results of individual Strategic Statements. The Calls to Economic Prosperity recommend specific actions to achieve the outcomes described in the Strategic Statements. This document is not intended as a strategic plan specifically, but rather a strategy that others can incorporate into their own strategic plans.

Household Food Insecurity in Canada, 2017-2018

Food insecurity – inadequate or uncertain access to food because of financial constraints – is a serious public health problem in Canada, and all indications are that the problem is getting worse. Drawing on data for 103,500 households from Statistics Canada’s Canadian Community Health Survey conducted in 2017 and 2018, we found that 12.7% of households experienced some level of food insecurity in the previous 12 months. There were 4.4 million people, including more than 1.2 million children under the age of 18, living in food-insecure households in 2017-18. This is higher than any prior national estimate.

Impact of the COVID-19 Crisis on Montreal “Cultural Communities”

This exploratory study aims to better understand the challenges experienced by members of cultural communities in Montreal, particularly the most disadvantaged groups, during the COVID-19 pandemic in the Spring of 2020.

Colour of Poverty – Colour of Change

There is a growing "colour-coded" inequity and disparity in Ontario that has resulted in an inequality of learning outcomes, of health status, of employment opportunity and income prospects, of life opportunities, and ultimately of life outcomes. Colour of Poverty-Colour of Change believes that it is only by working together that we can make the needed change for all of our shared benefit These fact sheets provide data to help understand the racialization of poverty in Ontario.

Housing insecurity and the COVID-19 pandemic

CFPB released their first analysis of the impacts of the COVID-19 pandemic on housing in the United States. Actions taken by both the public and private sector have, so far, prevented many families from losing their homes during the height of the public health crisis. However, as legal protections expire in the months ahead, over 11 million families — nearly 10 percent of U.S. households — are at risk of eviction and foreclosure.

Change Matters Volume 2: Assets

This is the second brief in a new series from The Financial Clinic. Change Matters leverages the data gathered through our revolutionary financial coaching platform, Change Machine, alongside the voices, wisdom, and lived experiences of Change Machine customers. We hope that our action oriented analysis will lead to positive social change. We believe we have a responsibility to ask the right questions, to use our data for good, and to inspire products, practice, and policy innovations that centralize the needs of the working-poor in building economic mobility.

Achieving financial resilience in the face of financial setbacks

The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Race, Ethnicity, and the Financial Lives of Young Adults: Exploring Disparities in Financial Health Outcomes

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults, focusing on Black and Latinx young adults, in order to inform policies, programs, and solutions that can improve financial health for all.

Majoring in Debt: Why Student Loan Debt is Growing the Racial Wealth Gap and How Philanthropy Can Help

More than 44 million people in America have taken on student debt to pursue a post-secondary education. These borrowers collectively owe around $1.6 trillion in student loan debt. Borrowers exist in every community, but some are particularly vulnerable to its impact. Women hold two-thirds of all outstanding student debt and Black and Latinx borrowers disproportionately struggle with repayment. This webinar discussed the disparate impact of student loan debt on black and Latinx students and the following topics:

Wealth and Health Equity: Investing in Structural Change

Building on the Asset Funders Network’s the Health and Wealth Connection: Investment Opportunities Across the Life Course brief, this paper details: On September 29th, AFN hosted a webinar to release the paper with featured speakers: Dr. Annie Harper, Ph.D., Program for Recovery and Community Health, Yale School of Medicine

Joelle-Jude Fontaine, Sr. Program Officer, Human Services, The Kresge Foundation

Dedrick Asante-Muhammad, Chief of Race, Wealth, and Community, National Community Reinvestment Coalition

Lifting the Weight: Consumer Debt Solutions Framework

Aspen Financial Security Program’s the Expanding Prosperity Impact Collaborative (EPIC) has identified seven specific consumer debt problems that result in decreased financial insecurity and well-being. Four of the identified problems are general to consumer debt: households’ lack of savings or financial cushion, restricted access to existing high-quality credit for specific groups of consumers, exposure to harmful loan terms and features, and detrimental delinquency, default, and collections practices. The other three problems relate to structural features of three specific types of debt: student loans, medical debt, and government fines and fees. This report presents a solutions framework to address all seven of these problems. The framework includes setting one or more tangible goals to achieve for each problem, and, for each goal, the solutions different sectors (financial services providers, governments, non-profits, employers, educational or medical institutions) can pursue.

Race to Lead: Women of Color in the Nonprofit Sector

This report reveals that women of color encounter systemic obstacles to their advancement over and above the barriers faced by white women and men of color. Education and training are not the solution—women of color with high levels of education are more likely to be in administrative roles and are more likely to report frustrations about inadequate and inequitable salaries. BMP’s call to action focuses on systems change, organizational change, and individual support for women of color in the sector.

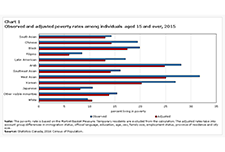

Economic impact of COVID-19 among visible minority groups

Since visible minorities often have more precarious employment and higher poverty rates than the White population, their ability to adjust to income losses due to work interruptions is likely more limited. Based on a large crowdsourcing data collection initiative, this study examines the economic impact of the COVID-19 pandemic on visible minority groups. Among the crowdsourcing participants who were employed prior to work stoppages, Whites and most visible minority groups reported similar rates of job loss or reduced work hours. However, visible minority participants were more likely than White participants to report that the COVID-19 pandemic had affected their ability to meet financial obligations or essential needs, such as rent or mortgage payments, utilities, and groceries.

Prosperity Now Scorecard

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to jump-start a conversation about solutions and policies that put households on stronger financial footing across five issue areas: Financial Assets & Income, Businesses & Jobs, Homeownership & Housing, Health Care and Education.

Advancing Health and Wealth Integration in the Earliest Years

Despite the well-documented connection between health and wealth, investing in this intersection is still a new approach for many grantmakers. With the goal of inspiring increased philanthropic attention, exploration, and replication, this new spotlight elevates responsive philanthropic strategies that support both health and wealth. This report focuses on the in utero-toddler stage of the life cycle (0-3 years). This age segment has some health-wealth integration activity, primarily through two-generation approaches. The goal is to inspire more philanthropic investment for this cohort by highlighting research and examples and offering recommendations.

Canada’s Colour Coded Income Inequality

Canada’s population is increasingly racialized. The 2016 census counted 7.7 million racialized individuals in Canada. That number represented 22% of the population, up sharply from 16% just a decade earlier. Unfortunately, the rapid growth in the racialized population is not being matched by a corresponding increase in economic equality. This paper uses 2016 census data to paint a portrait of income inequality between racialized and non-racialized Canadians. It also looks at the labour market discrimination faced by racialized workers in 2006 and 2016. These data provide a glimpse of the likely differences in wealth between racialized and non-racialized Canadians. This paper also explores the relationship between race, immigration and employment incomes. Taken together, the data point to an unequivocal pattern of racialized economic inequality in Canada. In the absence of bold policies to combat racism, this economic inequality shows no signs of disappearing.

Running in Place: Why the Racial Wealth Divide Keeps Black and Latino Families From Achieving Economic Security

This report examines data from the Federal Reserve System’s 2016 Survey of Consumer Finances to understand how the wealth of median Black, Latino and White families have changed since the findings of its previous survey were released in 2013.

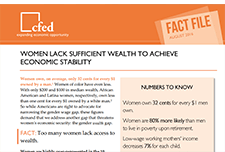

Fact File: Women Lack Sufficient Wealth to Achieve Economic Stability

Women own, on average, only 32 cents for every $1 owned by a man in America. Women of color have even less. Both the gender wage gap and the gender wealth gap need to be taken into account to address threats to women's economic security.

Promise Accounts: Matched Savings to Help Families Get Ahead

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the racial wealth divide means creating saving pathways for low-income households to build wealth. Promise Accounts make some key changes to traditional matched savings programs. Specifically, these accounts would have features including:

Do Tax-Time Savings Deposits Reduce Hardship Among Low-Income Filers? A Propensity Score Analysis

A lack of emergency savings renders low-income households vulnerable to material hardships resulting from unexpected expenses or loss of income. Having emergency savings helps these households respond to unexpected events, maintain consumption, and avoid high-cost credit products. Because many low-income households receive sizable federal tax refunds, tax time is an opportunity for these households to allocate a portion of refunds to savings. We hypothesized that low-income tax filers who deposit at least part of their tax refunds into a savings account will experience less material and health care hardship compared to non-depositors. Six months after filing taxes, depositors have statistically significant better outcomes than non-depositors for five of six hardship outcomes. Findings affirm the importance of saving refunds at tax time as a way to lower the likelihood of experiencing various hardships. Findings concerning race suggest that Black households face greater hardship risks than White households, reflecting broader patterns of social inequality.

The Political Economy of Education, Financial Literacy, and the Racial Wealth Gap

This article examines the mismatch between the political discourse around individual agency, education, and financial literacy, and the actual racial wealth gap. The authors argue that the racial wealth gap is rooted in socioeconomic and political structure barriers rather than a disdain for or underachievement in education or financial literacy on the part of Black Americans, as might be suggested by the conventional wisdom. Also, the article presents a stratification economic lens as an alternative to the conventional wisdom to better understand why the racial wealth gap persists.

The Ever Growing Gap: Without Change, African American and Latino Families Won’t Match White Wealth for Centuries

This report examines the growing racial wealth divide for Black and Latino and the ways that accelerating concentrations of wealth at the top compound and exacerbate this divide. It looks at trends in wealth accumulation from 1983 to 2013, as well as projections of what the next thirty years might bring. It also considers the impact public policy has had in contributing to the racial wealth divide and how new policies can close this gap.