Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

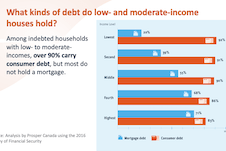

Report: Roadblock to recovery: Consumer debt of low- and moderate-income Canadian households in the time of COVID-19 (Prosper Canada)

Survey results: Canadians with incomes under $40K bearing the financial brunt of COVID-19 (Leger and Prosper Canada)

Time-stamps for the video recording:

4:42 – Agenda and introductions

7:52 – Audience polls

10:55 – Researching consumer debt (Speaker: Alex Bucik)

18:55 – How much does debt cost? (Speaker: Alex Bucik)

23:17 – How do different kinds of debt work? (Speaker: Alex Bucik)

29:17 – What are people using their credit for? (Speaker: Vivian Odu)

40:49 – What help is available to Canadian borrowers? (Speaker: Alex Bucik)

45:22 – Q&A

Majoring in Debt: Why Student Loan Debt is Growing the Racial Wealth Gap and How Philanthropy Can Help

More than 44 million people in America have taken on student debt to pursue a post-secondary education. These borrowers collectively owe around $1.6 trillion in student loan debt. Borrowers exist in every community, but some are particularly vulnerable to its impact. Women hold two-thirds of all outstanding student debt and Black and Latinx borrowers disproportionately struggle with repayment. This webinar discussed the disparate impact of student loan debt on black and Latinx students and the following topics:

Lifting the Weight: Consumer Debt Solutions Framework

Aspen Financial Security Program’s the Expanding Prosperity Impact Collaborative (EPIC) has identified seven specific consumer debt problems that result in decreased financial insecurity and well-being. Four of the identified problems are general to consumer debt: households’ lack of savings or financial cushion, restricted access to existing high-quality credit for specific groups of consumers, exposure to harmful loan terms and features, and detrimental delinquency, default, and collections practices. The other three problems relate to structural features of three specific types of debt: student loans, medical debt, and government fines and fees. This report presents a solutions framework to address all seven of these problems. The framework includes setting one or more tangible goals to achieve for each problem, and, for each goal, the solutions different sectors (financial services providers, governments, non-profits, employers, educational or medical institutions) can pursue.

Meeting the Emergency Moment: Key Takeaways from Delivering Remote Municipal Financial Counseling Services

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial counseling as a public service. Local leaders were able to offer FEC financial counseling as a critical component of their emergency response infrastructure; the fact that this service already existed, and was embedded into the fabric of municipal anti-poverty efforts, meant that it could quickly pivot to meet new COVID-19 needs, including through offering remote financial counseling. This brief describes how FEC partners identified the right technology; developed skills to deliver counseling remotely; messaged the availability of FEC services as part of their localities’ COVID-19 response; and shared lessons learned with their FEC counterparts around the country.

Credit Characteristics, Credit Engagement Tools, and Financial Well-Being

This report presents results from a joint research study between the Consumer Financial Protection Bureau (CFPB) and Credit Karma. The purpose of the study is to examine how consumers’ subjective financial well-being relates to objective measures of consumers’ financial health, specifically, consumers’ credit report characteristics. The study also seeks to relate consumers’ subjective financial well-being to consumers’ engagement with financial information through educational tools.

Better Borrowing: How State-Mandated Financial Education Drives College Financing Behaviour

As student loan reform continues to dominate national discourse, a NEFE-funded study shows that financial education in states with state-mandated personal finance graduation requirements causes students to make better decisions about how to pay for college. It increases applications for aid, federal aid taken, and grants — all while decreasing credit card balances. Put simply, financial education makes better borrowers. This study examines positive effects of state-mandated financial education graduation requirements. As of 2017, 25 states have implemented mandates for personal finance education prior to graduation.