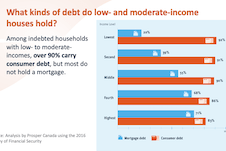

Household debt levels in Canada have been rising since the 1990s, which poses increasing risks for Canada’s economy and Canadians’ financial health. However, the debt ‘picture’ for an average low- or moderate-income household is likely to be quite different from higher income households, both in terms of amount of debt and type of debt they take on.

Join Alex Bucik and Vivian Odu, from Prosper Canada in this one-hour webinar where they present findings from recent Prosper Canada’s recent research on consumer debt in Canada, Roadblock to Recovery: Consumer debt of low- and moderate-income Canadians in the time of COVID-19. Alex and Vivian will explore what types of debt are more common in low- or moderate-income households, and some of the drivers of this debt load.

This webinar is intended to equip financial educators and frontline practitioners supporting low-income clients, with recent knowledge on the types of debt Canadians living on low income may be dealing with, and things to know about the pitfalls of different types of debt.

Click 'Get it' below to access the video link, and scroll down to access handouts, slides, and video timestamps for this webinar.