Discover financial empowerment resources

Discover financial empowerment resources

The CRA has put together a website for what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. This includes information on tax exemption and who is eligible. There is also information on...

The Financial Services Regulatory Authority of Ontario (FSRA) is responsible for protecting the rights of consumers in Ontario by promoting high standards of business conduct and transparency within the financial services they regulate. Financial services professionals are not required to use...

Low-cost accounts cost a maximum of $4 per month in banking fees. The Government of Canada and certain financial institutions have an agreement to provide low-cost basic banking services. If you meet certain conditions, you may be eligible for a low-cost account at no cost. No-cost accounts have...

Money and Youth starts with an exploration of one’s values and covers how to make good decisions – and be aware of those who will try to influence decisions and how they can go about doing so. The book then proceeds through a learning framework looking at the challenges and opportunities of...

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

The Canada Disability Benefit website is managed by Plan Institute, a national non-profit organization based in Burnaby, BC. The purpose is to provide individuals, families, and professionals across Canada with up-to-date information and resources on the Canada Disability Benefit (CDB). Their...

The Canadian Securities Administrators compiles a list of member investor alerts that is intended to assist the public and the securities industry in conducting due diligence. The subjects of these alerts are persons or companies who appear to be engaging in securities activities that may pose a...

As Nova Scotia’s population gets older, more people are thinking about, and getting closer to retirement, and many of them have built up a sizable investment portfolio over their lifetime. This has led to older adults in Nova Scotia, and throughout Canada, being targeted by investment fraud and...

This guide, prepared by FAIR Canada, will help consumers who have complaints against their bank or investment firm and want to be financially compensated for their losses. This guide provides and overview of external complaint-handling systems that may be available when seeking compensation. It is...

This guide by the Canadian Investment Regulatory Organization covers these topics: What are crypto assets? Blockchain technology Cryptocurrencies or crypto assets? Buying and selling crypto assets Alberta securities law for crypto assets and crypto asset trading platforms Holding your...

Struggling to pay your mortgage? FCAC expects federally regulated financial institutions to help you if you're struggling to pay your mortgage due to exceptional circumstances. Learn more about paying your mortgage when experiencing financial...

This CRA site has information on what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. There's also information on available tax filing...

This handbook from Money Mentors Alberta outlines the steps to rebuild your...

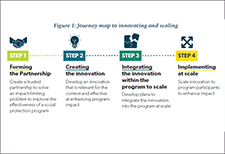

How can we ensure anti-poverty programs are doing the most good for those who need them? One important step is to invest in scaling successful innovations within these programs. With government-led poverty alleviation programs reaching millions of people worldwide, these programs can model how...

The SimpleFile by Phone service, formerly called File my Return, allows eligible individuals to auto-file their income tax and benefit return over the phone. It is free, secure, and easy to use. There are no forms to fill out or calculations to do. You do not need to speak to an agent to use this...

Tax-free savings accounts (TFSAs) are designed to help Canadians save more. This comprehensive resource page by the Ontario Securities Commission will help you learn more about TFSAs, what the annual contribution limits are, how to make transfers between TFSAs and the penalties for breaking...

This article by Credit Canada helps determine whether it's better to save for the future or pay off existing debts. The "priority pyramid" is a method of visualizing your areas of financial focus from most important to least...

Owning stocks means you own equity in a company. Stocks are traded on a stock exchange. Learn more about stocks and how they work by visiting the new...

There are rules about how much money a person living on Ontario Works can receive in gifts or “voluntary payments”. Generally, a person living on Ontario Works can receive gifts up to a maximum of $10,000 in a 12-month period. There are rules around reporting gifts, and decisions on how to...

In 2014, the government of BC declared October RDSP Awareness Month to help raise awareness about the Registered Disability Savings Plan (RDSP). The RDSP is the world’s first savings plan specifically designed for people with disabilities. Even with little to no personal contributions, there are...

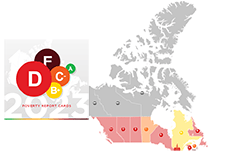

Food Banks Canada's all-new Poverty Report Cards initiative grades how poverty reduction efforts are going in the provincial, territorial, and federal governments. The report cards will help policymakers and decision-makers at all levels of government gauge their performance in the fight against...

Investing offers a way to potentially grow your money in a different way from savings. Many common investments involve the stock market. Head to the Ontario Securities Commission website to learn more about how investing...

There are many options to deal with debt, but if it sounds too good to be true—it probably is. Ask questions and shop around to avoid paying unnecessary fees. The Office of the Superintendent of Bankruptcy Canada has put together a host of useful tools around debt based on an individual's...

While there is no official definition of responsible or sustainable investing, many investors would like to adopt an investment approach that combines environmental, socials and governance (ESG) factors with traditional financial research. The Autorité des marchés financiers has compiled...

If you have a complaint, it is important you fully understand your rights, so that you don’t feel taken advantage of during the process. After reading the guide, you will: ● Know how and who to contact when you first make a complaint. ● Understand your basic rights during the process,...