Discover financial empowerment resources

Discover financial empowerment resources

Whether you’re on a vacation at a resort, waiting in the airport or sitting in a coffee shop, it’s often possible to connect to the Internet through a wireless network provided by the property owner. Sometimes these will be offered for a small fee and sometimes they will be free. But be...

Tips and tools to help you recognize, prevent, and report scams, keeping your finances and personal information safe. Available in...

Scams come in many forms—whether it is a suspicious text, a phishing email, an unexpected phone call, or a fake website. Scammers are always coming up with new ways to trick people, but you can protect yourself by staying alert. If you ever suspect you have been targeted by a scam, it is...

The Canadian Bankers Association’s Cyber Security Toolkit for Newcomers to Canada, developed in collaboration with Get Cyber Safe, aims to educate newcomers on cyber hygiene best practices and empower them so that they are equipped to recognize and avoid common scams in Canada. The Toolkit...

The banking industry has long recognized that it has a role to play strengthening the financial literacy skills of all Canadians. That’s why the CBA administers Your Money Seniors, a free, non-commercial seminar program developed in collaboration with the Financial Consumer Agency of Canada...

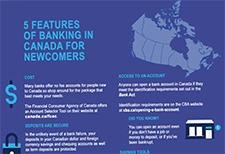

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. Here is some basic information to get you started. A list of bank resources at the end of this article may also help with the...

The Canadian Bankers Association has created a new Cyber Security Awareness Quiz site to test your knowledge and ability to spot a “phishy” email, message or...

Banks take fraud very seriously and have highly sophisticated security systems and teams of experts to protect you from financial fraud. As a banking customer, there are also simple steps you can take to recognize cyber crime and protect your personal information and your money. Educating yourself,...

While cyber criminals are always looking for ways to trick you into revealing information they can use to access your accounts, we have a few simple tips to avoid getting tricked by “one time passcode” scams that you may encounter while attempting to access your accounts...

There are also simple steps you can take to recognize cyber threats and protect yourself. With a cyber hygiene checklist and tips on how to spot common scams, the CBA’s Cyber Security Toolkit can help you protect against online financial...

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world....

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the...

Many of us have shifted some of our shopping online during the pandemic – it’s easy and very often you can have items delivered right to your door. Criminals are taking advantage of the increased popularity of online shopping by creating fake websites and apps that look authentic but are just a...

The coronavirus pandemic has tested the limits of Canadians over the past 20 months. What began as a health crisis quickly morphed into an economic crisis, with the spread of COVID‑19 shocking large segments of the economy and leaving many without paycheques. While no generation has been...

The CBA partnered with Credit Counselling Canada, an association of accredited non-profit credit counselling agencies, to offer the Debt and Money Quiz. The online tool helps Canadians assess their financial health and provides recommendations to help those who are struggling...

Your Money Seniors is a financial literacy program for seniors. Modelled on the CBA’s highly successful Your Money Students program, this seminar program is offered in French and English, free of charge, to seniors’ groups across the country. Your Money Seniors is presented by bankers in...

Your Money Students was created to bring financial literacy to life in homes and classrooms across Canada. This free, one-hour, non-commercial seminar is geared for high school students, and is presented by local bankers volunteering their time and expertise. The Your Money Students seminar covers...