Discover financial empowerment resources

Discover financial empowerment resources

Money Smarts: My Financial Journey is an engaging board game designed for Indigenous youth aged 12 and older. The game introduces players to essential financial literacy concepts through realistic scenarios, encouraging them to develop practical skills for managing their own financial...

American Indian and Alaska Native (AI/AN) peoples have long faced barriers to asset building. More than half of AI/AN populations are un- or underbanked, financial services often don’t operate on reservations, and access to capital is difficult. Native peoples have been excluded from financial...

New data tables on the labour activities of Indigenous Peoples are now available. Data are from the 2017 Aboriginal Peoples Survey and include information on labour force status, job satisfaction, skills training, skills that limit job opportunities, job permanency, part-time or full-time job...

There were 85 shelters for victims of abuse that had ties to First Nations, Métis or Inuit communities or organizations operating across Canada in 2017/2018. These Indigenous shelters, which are primarily mandated to serve victims of abuse, play an important role for victims leaving abusive...

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance...

Answer the questions in this Government of Canada online tool to get a customized list of benefits for which you may be eligible. The Benefits Finder may suggest benefits from federal, provincial or territorial...

This is the video recording of the AFOA 2014 Conference panel on Indigenous Financial Literacy. In this session, Liz Mulholland, Dr. Paulette Tremblay, Simon Brascoupe, and Darren Googoo discuss Indigneous financial wellness, financial literacy, and community...

This brief is a companion resource to Building Financial Capability: A Planning Guide for Integrated Services (also known as the Guide) and provides real-world examples of financial capability integration efforts. The brief shares lessons and approaches for how tribal-serving organizations can...

Research conducted by agencies such as AFOA, Native Women’s Association of Canada, and various other Canadian entities, has identified the need for improved financial literacy education in Indigenous communities, particularly among youth and Elders. Such research reports are often equipped with...

This webinar is all about Managing your money, a resource developed to support money conversations and workshops with Indigenous individuals or families. We all strive to achieve a good life or Miyupimaatisiiun. The Managing your money booklet offers a series of seven simple and engaging...

Bright, beautiful, interactive and simple to use, Managing your money offers a series of seven worksheets to help Indigenous individuals and families to set and work towards money goals. Each financial topic and activity features artwork by Simon Brascoupé paired with a teaching from the animal...

This webinar, "Planning a successful community tax clinic in Indigenous communities, Part 2," is the second in a 2-part series sharing information, community examples and promising practices with Ontario First Nation communities and Indigenous organizations to support the launch and planning of...

This webinar, "Planning a successful community tax clinic in Indigenous communities (Part 1)," is part one of two webinars trainings which share information, community examples and promising practices from Ontario First Nation communities and Indigenous organizations. This training will support the...

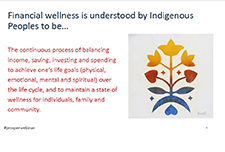

This webinar, "Indigenous financial wellness in Canada," introduces an Indigenous financial wellness framework, identifies some of the key barriers and opportunities for building financial wellness in Indigenous communities, and highlights evidence-based best practices for building financial...

Even if you make no money, you should file a tax return each year. You may be eligible for a refund (money back). Filing your taxes triggers access to government benefits that you can’t get any other way. This worksheet will help you gather the information you will need at tax time. You will...

Setting a savings goal means that you have decided how much money you can put away, and what you are going to save for. This activity can help you write down some money goals and when you would like to achieve them. You can build savings by putting aside small amounts on a regular basis. This is...

When you make a budget, you give yourself a clear picture of your financial situation. A budget compares your income to your expenses, all in one place. This is worksheet #5 from the booklet 'Managing your...

Knowing what bills you have and when they are due can help you plan your spending. This activity will help you to be aware of two things: how much you owe each month, and at what time of the month that money is due. This will help you to pay bills on time, and avoid late fees. This is worksheet...

Keeping track of where your money goes during the month is another helpful step towards making a budget. Then you will be able to compare your spending with your income. This is worksheet #3 from the booklet 'Managing your...

Income is the money that comes into your household. This worksheet will help you see the ‘big picture’ of your income and other resources. Then you can think about how to plan your expenses. This is worksheet #2 from the booklet 'Managing your...

Some of us are able to save regularly. Some of us feel like there is never enough money to get by or any left over to save. Without a plan, budgeting and saving can feel stressful and overwhelming. This activity will help you think about your goals. Setting goals is the first step in making a...

This is a pre-budget presentation from the Government of Canada on the state of the middle class in Canada. Middle class challenges, successes, and government commitments. All Canadians benefit from strong, sustained, and inclusive economic growth and everyone has a real and fair chance at economic...

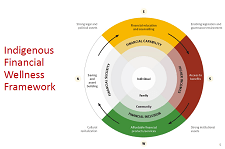

This is a presentation by Jerry Buckland at the AFOA Canada Conference in February 2017. It covers: 1.An Indigenous Financial Wellness Framework: demonstrates the need to boost capability and inclusion; 2.Results from a Manitoba case study of financial exclusion; 3.Lessons from abroad: the...

Living in a community with lower socioeconomic status is associated with higher mortality. However, few studies have examined associations between community socioeconomic characteristics and mortality among the First Nations population. The Community Well-Being Index (CWB), a measure of the social...

This article examines the literacy and numeracy skills of off-reserve First Nations and Métis adults, focusing on the factors and labour market outcomes associated with higher skill levels. In this study, individuals in the higher range for literacy and numeracy are defined as those who scored...