Discover financial empowerment resources

Discover financial empowerment resources

Wellesley Institute’s Thriving in the City1 framework is a valuable tool for understanding what resources an individual needs to live a healthy life and assessing how the current policy environment meets these needs. While the previous report focused on working-age adults (25-40 years old),2 this...

The affordable housing crisis in Canada creates many challenges for millions of people trying to find a place to live that they can afford. For many marginalized renters, discrimination presents additional barriers making it even harder for them to find a home. To better understand these...

Tables for 14 indicators in Canada's Quality of Life Framework have been updated to include Canadian Social Survey data collected from October to December 2024 (fourth quarter of 2024). These indicators include life satisfaction, sense of meaning and purpose, future outlook, loneliness,...

Investing can be a great way to grow your wealth, but it’s important to understand the tax implications that come with it. In Canada, the taxation of investment income varies depending on the type of investment and the account in which it is held. Access this resource by the Canadian Investment...

Canada is facing housing affordability challenges. In 2021, one in five households (20.9%) lived in unaffordable housing, defined as spending 30% or more of household total income on shelter costs (Statistics Canada, 2022c). Some estimates have projected a need for an additional 3.5 million housing...

The COVID-19 pandemic and post-pandemic recovery were “feast and famine” for the budgets of low-income families and individuals across Canada. Because of the income support programs put in place to help Canadians affected by workplace shutdowns, the poverty rate fell to 6.4% in 2020, down by...

In 2019, Canada’s National Housing Strategy Act recognized housing as a human right. This report highlights the progress, partnerships, and collective actions that have driven the right to housing movement forward, with a particular focus on key milestones and achievements in...

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

Women and girls are highlighted within Canada’s National Financial Literacy Strategy as a diverse population that can benefit from tailored approaches to strengthen financial resilience. To help close the gender gap, the Financial Consumer Agency of Canada (FCAC) developed and tested the benefits...

In 2023, the Financial Consumer Agency of Canada (FCAC) and researchers from Carleton University developed and tested the effectiveness of brief, online interventions at improving the financial confidence, financial knowledge and positive financial behaviours of young women ages 16–25. To...

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

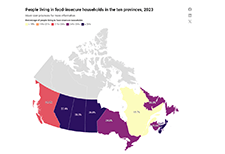

In 2023, 22.9% of people in the ten provinces lived in a food-insecure household. That amounts to 8.7 million people, including 2.1 million children, living in households that struggled to afford the food they need. With another year of rising food insecurity, the percentage of people affected is...

A new OSC behavioural science experiment reveals Canadians are equally open to investment suggestions from AI systems and human advisors. As the use of AI increases, understanding the role of AI in supporting retail investor decision-making is important. While AI presents a range of opportunities...

Following the crowd can help you simplify complex decisions like investing. But you could lose money by investing in something just because everyone else is. Find out how to avoid herd behaviour by watching this video from the Ontario Securities...

Individuals with lower incomes may face a range of economic challenges and barriers to upward mobility. Two types of services that may both contribute to the goal of improving individuals’ financial situations are employment and training (E&T) services, which have the goal of improving...

Investment firms are required to provide to each client an annual summary of all fees paid the previous year for services and advice. These requirements result in greater transparency about what you are paying, either directly or indirectly, for investment advice and other...

The 2021-2023 Building Financial Wellness in First Nations (FWFN) project - led by Prosper Canada and funded by IG Wealth Management - aimed to integrate culturally appropriate financial wellness supports into existing services in Manitoba and Ontario First Nation...

Filing a tax return is one of the most important ways for Canadians to access income benefits. However, numerous barriers can make tax filing challenging, particularly for people living on low incomes. After engaging with 31 individuals, we discovered that there are disruptors and compounders that...

The Office of the Investor at the Canadian Investment Regulatory Organization (CIRO) engaged with Innovative Research Group to conduct the organization’s first national investor survey. The objective of this general population (and particularly investors) survey research is to help CIRO better...

Maytree recently published the latest count of social assistance recipients in Canada. Learn how many people in each province or territory were receiving social assistance in 2022-23, and how those numbers have changed over...

In 2020, the Indigenous Consumer Assistance Network (ICAN) set out to widen the scope of its financial counselling services by looking at how it could deliver a holistic financial counselling framework that could better meet the financial and well-being needs of its service users. Over the past...

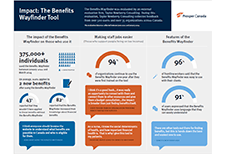

The external evaluation firm, Taylor Newberry Consulting, evaluated the Benefits Wayfinder between June 2022 and January 2024. This infographic showcases the feedback received based on feedback collected from 500 users and over 35 organizations across Canada. Impact: L'orienteur en mesures...

Visitors to the Learning Hub may read past copies of the quarterly Learning Hub Digest where we share quarterly updates to keep you informed on the latest financial empowerment, resources, research, and learning events. Issue 17: December 2025 Issue 16: September 2025 Issue 15: June 2025 Issue...

One of the goals of The Money and Pensions Service (MaPS) is to provide better debt advice. While debt advice is available in many different forms, many people who could benefit from debt advice do not seek help. In this study, we sought to better understand the barriers and drivers to people...

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...