Discover financial empowerment resources

Discover financial empowerment resources

This report explores the barriers newcomers face in accessing credit, and opportunities for governments, financial institutions, settlement agencies, fintech, investors and funders, and community organizations to better respond to this growing segment of the...

Scams come in many forms—whether it is a suspicious text, a phishing email, an unexpected phone call, or a fake website. Scammers are always coming up with new ways to trick people, but you can protect yourself by staying alert. If you ever suspect you have been targeted by a scam, it is...

What do we know about the millions of people working in Canada’s nonprofit sector? This report by Imagine Canada provides a detailed profile of these workers, including demographic and salary information, and uncovers how the nonprofit workforce differs significantly from the broader Canadian...

Canada’s Black population has grown significantly over the last two decades and now accounts for 4.3% of the Canadian population. This diverse community includes those with deep historical roots, particularly in Atlantic Canada, alongside recent migrants from the Caribbean, Africa and beyond....

The affordable housing crisis in Canada creates many challenges for millions of people trying to find a place to live that they can afford. For many marginalized renters, discrimination presents additional barriers making it even harder for them to find a home. To better understand these...

From 2019 to 2022, among Indigenous people aged 18 years and older, 54.3% of Inuit reported having a regular healthcare provider, along with 81.4% of First Nations people living off reserve and 84.5% of Métis. This is compared with 85.7% of the non-Indigenous adult population. Released...

Tables for 14 indicators in Canada's Quality of Life Framework have been updated to include Canadian Social Survey data collected from October to December 2024 (fourth quarter of 2024). These indicators include life satisfaction, sense of meaning and purpose, future outlook, loneliness,...

The CRA has launched taxology podcasts. These weekly informal sessions address different topics whether you’re starting your first job, doing your first return, or need a refresher on the basics. CRA hosts talk to experts to share tips and answer top questions to help listeners understand the...

Canada is facing housing affordability challenges. In 2021, one in five households (20.9%) lived in unaffordable housing, defined as spending 30% or more of household total income on shelter costs (Statistics Canada, 2022c). Some estimates have projected a need for an additional 3.5 million housing...

The COVID-19 pandemic and post-pandemic recovery were “feast and famine” for the budgets of low-income families and individuals across Canada. Because of the income support programs put in place to help Canadians affected by workplace shutdowns, the poverty rate fell to 6.4% in 2020, down by...

The Government of Canada has created a digital toolkit for Black History Month 2025. Click on "Access this resource" to download a Black History month poster, a virtual background for video...

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

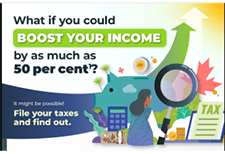

This infographic provides a helpful visual summary of tax benefits that can add to income or reduce the taxes people in Canada pay when they file their tax return. The information is especially useful for people in Canada who: Are working or living on a low income; Live with a...

This year marks the 35th anniversary since the passing of the unanimous all-party federal resolution to end child poverty in Canada by the year 2000. Using tax filer data from 2022, the latest available, this year’s report card found a troubling trend: child poverty increased at record rates two...

In partnership, Daily Bread Food Bank and North York Harvest Food Bank have released Who’s Hungry 2024 – an annual profile of poverty and food insecurity in the City of Toronto. In the last year, there were 3.49 million client visits to Toronto food banks – nearly 1 million more visits...

One of the core strategic priorities identified in FAIR Canada's 2023 -2028 Strategic Plan was to conduct and share research that provides deeper perspectives directly from individual investors about key policy matters that have an impact on them. As part of this effort, FAIR Canada commissioned an...

Fraudsters are master manipulators who leverage relationships to build trust and exploit you financially. Technology makes it easy to become a victim as bad actors can, pretend to be someone you know online, or use artificial intelligence to trick you. According to data from the Canadian Anti-Fraud...

Interpreting the data: Key takeaways from Welfare in Canada, 2023. For nearly 40 years, the annual Welfare in Canada series and its predecessors have documented the depth of poverty that persists for people receiving social assistance. The 2023 edition builds on this work to provide a...

Have you ever wondered why people behave in certain ways, and how you can encourage positive outcomes? Behavioural insights is one tool that can support you to meet people where they are at. United Way partnered with the Behavioural Insights team of Canada to develop a course for the social sector,...

The Welfare in Canada reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and...

Maytree has compiled an advocacy toolkit to help you advocate for the Canada Disability Benefit (CDB). This toolkit consists of an introduction, additional resources and frequently asked questions and the toolkit. You may download the toolkit by jurisdiction on their website: Advocacy...

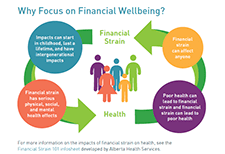

More and more people are having difficulties in covering day-to-day expenses, saving money, and paying down debts. The Financial Wellbeing Café Scientifique was an opportunity to bring people together to talk about how to drive action on financial wellbeing in Canada. The event included a...

The disability tax credit (DTC) is an important program for those facing severe and prolonged physical or mental impairment. Some individuals face unique barriers when it comes to completing their application and claiming the credit. On this page, the CRA is correcting some of the most common myths...

Maytree recently published the latest count of social assistance recipients in Canada. Learn how many people in each province or territory were receiving social assistance in 2022-23, and how those numbers have changed over...

CIRO sets and enforces rules for the business, trading and financial conduct of Member firms and their representatives across Canada. These rules protect investors. Access this resource to learn more about the benefits of working with a CIRO...