Discover financial empowerment resources

Discover financial empowerment resources

This one-hour webinar shares insights on why service design is so valuable for organizations and businesses, and what is involved in the service design process. The purpose of this webinar is to introduce you to what service design is, how it works, and what elements of service design you can take...

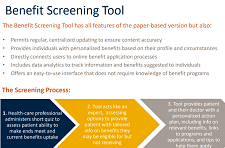

This report provides information on the results of Phase 1 of the Benefits Screening Tool project. Details on Phase 2 of the project (July 2016 to March 2018) are also included. The online Benefits Screening Tool (BST) enables health practitioners to screen patients for poverty and suggest...

This article describes development of the InCharge Financial Distress/Financial Well-Being Scale, designed to measure a latent construct representing responses to one’s financial state on a continuum ranging from overwhelming financial distress/lowest level of financial well-being to no financial...

The purpose of this article was to detail the process used to establish validity and reliability for a recently developed instrument measuring financial distress/ financial well-being. Knowing that the establishment of validity and reliability of an instrument is an ongoing process, and keeping in...

Evaluation of programs is crucial to gaining insight into what does and does not work, how best to adjust service delivery, and patterns and trends among clients. Yet, too often evaluation occurs only at the end of a project, is focused exclusively on informing funders and other outsiders, and is...

The toolkit was developed to assist other Canadian communities that are interested in adopting the Housing First approach. Primarily based on the experiences of the At Home/Chez Soi project, we have assembled tools and resources that are practical and user-friendly for groups and communities...

The authors developed and experimentally evaluated four novel educational programs delivered online: an informational brochure, a visual interactive tool, a written narrative, and a video narrative. The programs were designed to inform people about risk diversification an essential concept for...

The CFPB has developed a strategy and a range of initiatives to help consumers take control over their financial lives. Broadly, this strategy recognizes that financial literacy and financial capability require more than simply providing consumers with more information. Being able to manage one’s...

Building Financial Capability: A Planning Guide for Integrated Services provides a roadmap for community-based organizations that wish to integrate services that build clients’ financial capability within their existing programs. The Guide sets forth three basic approaches an organization can...

This paper has been written to engage community-based financial literacy organizations in thinking about evaluation. It summarizes the findings of the FLEP process including: a case for why evaluation matters; the state of financial literacy evaluation in Canada; key elements of the effective...