Discover financial empowerment resources

Discover financial empowerment resources

Rising housing costs have had an impact on the ability of families to move. This article, using data from the Canadian Social Survey (CSS), illustrates how higher prices have disproportionately affected the moving decisions of young Canadians, particularly those experiencing financial...

A government designs a great service or program to support its residents. Although many people qualify, the program receives just a few applications. How can we increase uptake? This is a common question the Behavioral Insights Team (BIT) has helped governments answer across many policy...

Individuals with lower incomes may face a range of economic challenges and barriers to upward mobility. Two types of services that may both contribute to the goal of improving individuals’ financial situations are employment and training (E&T) services, which have the goal of improving...

The Canada Disability Benefit is an opportunity to guarantee that people with disabilities can live a life with dignity and have an adequate standard of living. For the new Canada Disability Benefit (CDB) to meet its goal of financially supporting and reducing poverty of people with disabilities,...

This report presents the findings of research aimed at advancing social innovation and social finance in Canada. The study focused on understanding the enablers and barriers of social finance, as well as exploring why social purpose organizations (SPOs) engage in social finance. The research also...

November 26 is National Economic Abuse Awareness day. The Canadian Centre for Women's Empowerment has published their report on the state of economic abuse in Canada; championing financially strong futures for survivors. Here are some additional resources of potential interest: The economic...

In this blog, John Stapleton breaks explains income security and personal tax systems in Canada in the simplest way...

Brought to you from CPA Canada, this financial literacy podcast talks about key issues, trends and tips as they relate to financial education. Season 7 of the Mastering Money podcast takes a deep dive into debt and the way it affects Canadians. Season 6 of the Mastering Money podcast will help...

One of the consequences of social distancing and other restrictions, during the pandemic, such as those on business operating hours, is that consumers spent more of their time searching for information, shopping, and streaming entertainment on-line. With more free time on their hands and money in...

This National Indigenous Economic Strategy for Canada is the blueprint to achieve the meaningful engagement and inclusion of Indigenous Peoples in the Canadian economy. It has been initiated and developed by a coalition of national Indigenous organizations and experts in the field of economic...

While much research has been conducted on how giving is correlated to factors like educational attainment or income level, the influence of ethnicity has been elusive. This research attempts to better understand how newcomers to Canada and second-generation Canadians perceive and approach giving...

This self-paced online course will help you learn about behavioural insights and how they can help you increase impact in simple, practical ways. In this self-paced learning experience, you will learn foundational skills and tools that you can apply immediately to your work, creating a long-lasting...

This report identifies behaviourally informed techniques dealers and advisers can use to encourage their older clients to provide the necessary information for enhanced investor protection...

With speakers from CCFWE, Johannah Brockie - Program Manager for Advocacy and System Change and Jessica Tran - Program Manager for Education and Awareness, this webinar will guide you through the definition of economic abuse, how to identify an economic abuser, impacts of economic abuse, Covid-19...

The Canada Revenue Agency administers dozens of cash transfer programs that require an annual personal income tax return to establish eligibility. Approximately 10–12 percent of Canadians, however, do not file a return; as a result, they will not receive the benefits for which they are otherwise...

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and...

Based on an extensive literature review and re-analysis of existing qualitative data, this report offers a working definition and an a priori conceptual model of financial well-being and its possible determinants. Using survey data from Norway (2016), ten regression models have been conducted to...

This research report identifies behaviourally informed ways that government, regulators, employers, and financial institutions can encourage retirement planning. Thirty different initiatives and tactics that could be implemented by a variety of stakeholders to encourage retirement planning are...

Recent years have seen an explosion in interventions designed to improve financial outcomes of participants. Yet on-the-ground evidence suggests that not all financial education programs are equally successful at achieving this aim. This paper examines the difference between interventions that...

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular...

This publication presents key findings for financial education, drawn from the IOSCO/OECD joint report “The Application of Behavioural Insights to Financial Literacy and Investor Education Programmes and Initiatives”. It gives a short overview of the ways in which behavioural insights are...

An emerging body of international literature is beginning to reveal a significant connection between financial capability metrics and personality, suggesting that what influences our financial well-being may be more nuanced than we previously thought. This report investigates how the inclusion...

This guide is designed to be a resource for programs working with low income families to use when anticipating or implementing a new approach, such as coaching, to doing business. It helps you to systematically – and honestly – look at your foundational readiness for change, so that the...

This paper assesses the extent to which education level affects how Canadians save and accumulate wealth for retirement. Data from administrative income-tax records and responses from the 1991 and 2006 censuses of Canada show that individuals with more schooling are more likely to contribute to a...

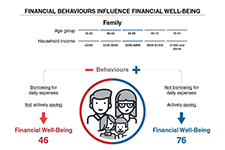

This backgrounder reports preliminary findings from a survey of financial well-being among Canadian adults. Preliminary analysis of the survey data indicates that two behaviours are particularly important in supporting the financial well-being of Canadians. First, our analysis indicates that...