Discover financial empowerment resources

Discover financial empowerment resources

Considerations and best practices for drop-off and virtual tax filing...

Program strategies grounded in an understanding of your community can increase the likelihood of engagement and follow-through. The following resources are intended to support VITA programs with implementation strategies at key program stages, like outreach and intake, and offer examples of how...

This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to...

In this report, The Common Cents Lab and MetLife Foundation share findings from the experiments we have run over the past several years with VITA providers to improve tax-related outcomes. We encourage you to consider implementing these ideas and engaging in additional conversations about how to...

Tax time financial capability services offered at Volunteer Income Tax Assistance (VITA) sites range from encouraging taxpayers to save a portion of their refund to free credit reviews, to referrals to financial coaching, and others in between. This report from Prosperity Now summarizes research...

This is Prosperity Now’s Taxpayer Opportunity Network VITA Volunteer Training platform, designed to help VITA volunteers (in the United States) train and become certified to provide free tax preparation services. These resources can provide a complete training or supplement the training offered...

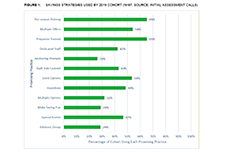

Many volunteer income tax assistance (VITA) sites experience inaccuracy in the taxes prepared according to audits conducted by the treasury inspector general for tax administration (TIGTA). Effective training strategies may influence the accuracy rates of tax returns prepared at VITA sites....

Most rural Native VITA sites, unlike urban VITA sites, face a unique set of challenges. The geographic isolation, low volunteer retention rates, economically distressed communities, and overall distrust of the federal government among many Native Americans can limit the success of traditional...

Volunteer Income Tax Assistance (VITA) sites are a useful tool for providing free tax preparation services to low-to-moderate income people and helping them claim a range of valuable tax credits, including the Earned Income Tax Credit. In addition, they can help individuals avoid high fees for tax...

Every year there is one key and predictable moment – tax time – when many consumers who are struggling to make ends meet have an opportunity to choose to build savings that will insulate them from some of the financial stress that may occur later in the year. In 2013, nearly 93 million...

This brief highlights findings from a small-scale pilot that integrated Virtual Volunteer Income Tax Assistance (VITA) services at two New York City Head Start programs during the 2013 tax season. The New York City Department of Consumer Affairs Office of Financial Empowerment (OFE) coordinated the...

More than $3.89 billion in federal income taxes have been returned to those with modest wages as a result of free tax preparation services offered by IRS-certified volunteers in 2014. A new breakdown of national IRS data shows that tax preparers at Volunteer Income Tax Assistance (VITA) sites and...