Discover financial empowerment resources

Discover financial empowerment resources

Financial freedom is possible. Start by understanding your financial situation. Use these free resources to help you manage your money, get out of debt and plan for...

Some say money talks, but many people feel uncomfortable talking about money. However, talking openly about your finances with people you trust can be an important step in reaching your goals. It may be tough to talk about money with close family and friends, but it can be helpful. To break the...

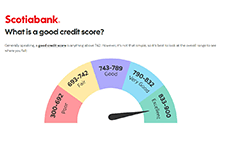

Looking to give your credit score a lift? Credit Canada can show you how to obtain your credit score, what it means, and how to get it into better shape. Click on "Access this resource" to learn...

While your credit score is a number to quickly show how creditworthy you are, your credit report is more detailed. It covers your entire credit profile and includes information such as personal information, credit account (including credit cards, lines of credit, mortgages...),...

Many of us struggle to talk about money, especially when it comes to talking about debt. It is when debt becomes too much for us to manage, or when we do not have a plan to pay it off, that it can become stressful and even overwhelming. This is when it is time to have those tough conversations and...

Financial fraud can be stressful and time-consuming experience. It can affect you both financially and emotionally. If you are defrauded, or suspect that you may have been defrauded, follow the steps outlined in this...

This report summarizes the information gathered by the Consumer Financial Protection Bureau (CFPB) regarding certain consumer complaints transmitted by the CFPB to the three largest nationwide consumer reporting agencies - Equifax, Experian and...

This educational brief from CLEO explains what a credit report is, and what to do if you want to fix your credit report or work with a credit repair...

Your Money Students was created to bring financial literacy to life in homes and classrooms across Canada. This free, one-hour, non-commercial seminar is geared for high school students, and is presented by local bankers volunteering their time and expertise. The Your Money Students seminar covers...

Very little is known about the number or characteristics of credit invisibles or consumers with unscored credit records. This Data Point documents the results of a research project undertaken by Staff in the Office of Research of the Consumer Financial Protection Bureau (CFPB) to better...

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Glossary of terms for credit reporting. To view full Financial Literacy Facilitator Resources, click...

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Web resources for credit reporting in Canada. To view full Financial Literacy Facilitator Resources, click...

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Ways to improve your credit score. To view full Financial Literacy Facilitator Resources, click...

This handout is from Module 7 of the Financial Literacy Facilitator Resources. How to correct common errors on credit reports. To view full Financial Literacy Facilitator Resources, click...

This handout is from Module 7 of the Financial Literacy Facilitator Resources. The information in an Equifax credit report varies slightly from a TransUnion credit report, but both contain the same basic sections. To view full Financial Literacy Facilitator Resources, click...

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A sample of a credit report received from Equifax. To view full Financial Literacy Facilitator Resources, click...

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus summarize your credit use in a report. The credit report is one of the main things lenders look at when they decide whether or not to give you credit. A credit report contains your history of credit...

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus are agencies that collect information about how we use credit. They produce personal credit reports. Credit bureaus are private companies. They are regulated by the province, but they are not part of...

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the TransUnion request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click...

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the Equifax request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click...

Your credit report is important for your financial health. It can help you get approved for credit cards and other loans. It can also affect your ability to rent housing or get hired for a job. Protect your credit report by checking carefully for errors and signs of identity theft. You have the...

This short guide explains the process of getting debt management help from a credit counselling agency. Credit counselling agencies provide a range of services for people in financial difficulty. One of the most common services they offer is help with finding the best strategy to pay off your debt...

You have the right to see your own credit report. And there are ways you can order it for free. It is a record of your past and present use of credit cards and loans. Mobile phone and Internet accounts may also be included, even though they are not credit accounts. It includes details about your...

Americans rely on credit and savings to weather financial shocks and build a better future, but for the financially struggling these tools are often unavailable when they need them. To better understand the intersection between savings and credit for consumers, Visa partnered with CFSI on...

The CFPB has developed a strategy and a range of initiatives to help consumers take control over their financial lives. Broadly, this strategy recognizes that financial literacy and financial capability require more than simply providing consumers with more information. Being able to manage one’s...