Discover financial empowerment resources

Discover financial empowerment resources

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

Some say money talks, but many people feel uncomfortable talking about money. However, talking openly about your finances with people you trust can be an important step in reaching your goals. It may be tough to talk about money with close family and friends, but it can be helpful. To break the...

This handbook from Money Mentors Alberta outlines the steps to rebuild your...

Looking to give your credit score a lift? Credit Canada can show you how to obtain your credit score, what it means, and how to get it into better shape. Click on "Access this resource" to learn...

With the holidays now behind us, it’s time to focus on what’s ahead: a fresh year full of possibilities. Many individuals have popular New Year’s resolutions involving better nutrition, weight loss and work-life balance. Yet others decide that now is the time to focus on enhancing their...

Debt can be a useful financial tool. Loans can help you buy a car or a home. And if you use credit cards, you can sometimes collect other benefits like travel miles or points you can spend. However, too much debt can make it difficult to save money and limit your financial options now and in the...

This free new course for newcomers consists of 4 short modules that should take 10-15 minutes each to complete. Each module includes short case studies, mini quizzes and other interactive elements. The topics for each module are: Essentials of credit in Canada How to build your credit...

The average Canadian tax return amount in 2023 is $2,072 and that money can go a long way when it comes to meeting your financial goals. But remember, this isn’t a cash windfall; it’s YOUR money that the government borrowed from you, so Credit Canada recommends using it for needs versus...

While your credit score is a number to quickly show how creditworthy you are, your credit report is more detailed. It covers your entire credit profile and includes information such as personal information, credit account (including credit cards, lines of credit, mortgages...),...

Financial fraud can be stressful and time-consuming experience. It can affect you both financially and emotionally. If you are defrauded, or suspect that you may have been defrauded, follow the steps outlined in this...

Fraud comes in many forms. Learn about the different types of fraud and ways to protect yourself using the links below. 8 common investment scams Boiler room scams Pump and dump scams Recovery room scams Affinity fraud Identity theft Romance scams Fraudster trick (email spam...

During the Four Actions that Can Hurt Credit Scores webinar, you'll learn about: Key events which can bring down credit scores How collections are reported to credit bureaus and how long they affect scores What can happen to credit scores when you apply for too much credit in a short amount...

This report presents the results of a Consumer Financial Protection Bureau (CFPB) funded evaluation of a Credit Builder Loan (CBL) product. CBLs are designed for consumers looking to establish a credit score or improve an existing one, while at the same time giving them a chance to build their...

Aspen Financial Security Program’s the Expanding Prosperity Impact Collaborative (EPIC) has identified seven specific consumer debt problems that result in decreased financial insecurity and well-being. Four of the identified problems are general to consumer debt: households’ lack of savings...

This report presents results from a joint research study between the Consumer Financial Protection Bureau (CFPB) and Credit Karma. The purpose of the study is to examine how consumers’ subjective financial well-being relates to objective measures of consumers’ financial health, specifically,...

Everyone needs to bank and nearly everyone has a relationship with at least one financial institution. Financial Institutions need relationships with consumers too, in order to thrive as businesses. The role these relationships play in financial decision making for Canadians is an important...

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from...

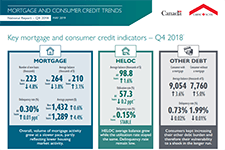

The Canada Mortgage and Housing Corporation (CMHC) publishes a quarterly report on Canadian trends relating to mortgage debt and consumer borrowing. Find out the level of Canadian household indebtedness, and emerging trends in outstanding debt balances in different urban areas and by age...

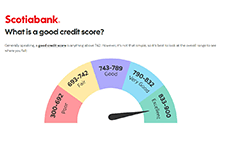

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A credit score is a score between 300 and 900 that credit bureaus use to rate the information in your credit report. Credit bureaus use a mathematical formula based on many factors to arrive at your credit score. To...

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. Credit score scenarios to practice learning. To view full Financial Literacy Facilitator Resources, click...

This is a detailed guide from the FCAC on how to read your credit report and understand your credit score. Building a good credit history is important for your financial health. Along with millions of other Canadians, you have a credit history that is kept on file by companies called credit...

This guide informs on credit and debt in Canada, including types of credit, credit cards, dealing with collection agencies, and tips for managing...

An individual’s financial literacy and access to basic financial services affects household financial stability and may have long-term effects on financial well-being. With this Study, we have sound empirical evidence regarding which families are most vulnerable and where action is needed most....

Americans rely on credit and savings to weather financial shocks and build a better future, but for the financially struggling these tools are often unavailable when they need them. To better understand the intersection between savings and credit for consumers, Visa partnered with CFSI on...

The challenges that credit invisibles and consumers with unscored records face in accessing credit markets has generated considerable attention from researchers and industry participants. Despite all of this attention, very little is known about the number or characteristics of credit invisibles...