Discover financial empowerment resources

Discover financial empowerment resources

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

The Dollars Seen Differently podcast breaks down financial topics to make them more accessible for people who are blind, Deafblind or have low vision. Hosted by Ryan Hooey, each episode features a down-to-earth conversation with financial experts, offering practical tips and resources on topics...

Enrolling in post-secondary education can be expensive. The Registered Education Savings Plan (RESP) is a dedicated savings plan designed to help you save for a child’s education after high school. Learn more about how RESPs work, the types of RESPs, and the fees involved by heading over to the...

There are many ways to invest. Your choices will depend on your goals, your timeline and your willingness and ability to accept risk. It’s important to know some basics. This article by CIRO outlines the 5 key principles of investing: can you afford it, diversification, invest for the long term,...

The benefits of spring cleaning can extend beyond your home. Your investment portfolio needs regular maintenance to maximize its performance. A good habit is to regularly review your investment portfolio throughout the year to make sure it aligns with your financial needs. Click on "Access...

The Future of Wealth Discussion Series consist of 1-hour virtual convenings that are open to the public and bring together leaders across sectors and disciplines to consider wealth-building objectives that Aspen FSP considers critical to creating widespread household financial well-being. Click on...

The Ontario Securities Commission (OSC) has launched Investing Academy by GetSmarterAboutMoney.ca as part of Financial Literacy Month. Learn the basics about investing, managing your money, and planning for the future. The courses are available in English or French, and include learning activities,...

The Canada Learning Bond is money available to children and youth born in 2004 or later from low and moderate income families. You can get up to $2000 from the Government of Canada by opening an Registered Education Savings Plan (RESP). You can access this money when you enroll in full-time or...

Saving is an important part of financial well-being. Saving money helps you manage short-term needs such as day-to-day spending. It protects you and your family during emergencies. It is the key to reaching your future hopes and dreams. Maybe you are recovering from a hard time financially and...

Saving for your child’s education can be difficult, especially if you are trying to save for multiple goals or pay down debt at the same time. The federal government offers contributions to your child’s Registered Education Savings Program (RESP) through its grant programs: the Canada...

It pays to make saving a habit. Review this article from the Ontario Securities Commission to look for easy ways to build saving into your life and to make it...

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at apprenticeship programs, CEGEPs, trade schools,...

Estimate your child(ren)'s future education costs, and see how your planned RESP savings, including contributions and grants, will cover those...

The Canada Education Savings Program (CESP) recently developed a Toolkit for Public Primary Caregivers to help child welfare organizations open Registered Education Savings Plans (RESPs) and access the Canada Learning Bond (CLB) for children in care. Most children in care automatically qualify...

The Canada Learning Bond is money that the Government of Canada adds to a Registered Education Savings Plan (RESP) to help pay the costs of full- or part-time studies after high school. If you are eligible for the Canada Learning Bond and have not already received it in an RESP, you will receive...

Momentum is a changing-making organization located in Calgary, Alberta that works with people living on low incomes and partners in the community to create a thriving local economy for all. In 2008, Momentum launched the StartSmart program to support families living on low incomes to open...

Children’s Savings Account (CSA) programs offer a promising strategy to build a college-bound identity and make post-secondary education an achievable goal for more low- and moderate-income children. CSAs provide children (starting in elementary school or younger) with savings accounts and...

This resource offers a set of common indicators that community organizations can use to measure the reach and impact of their financial empowerment (FE) programming. It is intended for any community organization that works to foster greater financial well-being for economically disadvantaged...

America Saves, a campaign managed by the nonprofit Consumer Federation of America, motivates, encourages, and supports low- to moderate-income households to save money, reduce debt, and build wealth. Information and tips for setting a savings goal, making a savings plan, how to save...

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular...

The ability to build assets allows an individual or family to meet long-term financial goals and create economic stability for the future. This toolkit contains resources on goal setting, action planning and information on financial products and government supports that can help with building...

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of...

This two-page brochure describes the benefits of acting now to receive $500 to help start saving for a child's education after high school. The brochure is also available in the following Indigenous languages: Canada Learning Bond – Cree Canada Learning Bond – Denesuline Canada Learning...

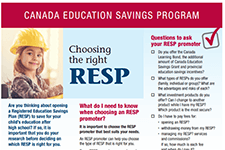

This printable brochure from the Government of Canada explains the key details you need to know when choosing a Registered Education Savings Plan (RESP) for your child's education...

This fact sheet from the Government of Canada answers Frequently Asked Questions about the Canada Education Savings Plan. This includes details about the Canada Learning Bond, the Canada Education Savings Grant, and Registered Education Savings Plans...