, Jul 2020

Why are lower-income parents less likely to open an RESP account? The roles of literacy, education and wealth

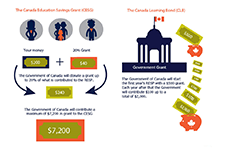

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of parents opening RESP accounts has increased steadily over time, as of 2016, participation rates remained more than twice as high among parents in the top income quartile (top 25%) compared with those in the bottom quartile.

This study provides insight into the factors behind the gap in (RESP) participation between higher and lower-income families.