Discover financial empowerment resources

Discover financial empowerment resources

For most households in America, financial shocks are inevitable. The car will break down. The house will need a repair. A key earner for a household will be laid off. These shocks can be devastating to household finances. And while the COVID-19 pandemic, which we are still recovering from, was a...

This report summarizes the results of a follow-up survey with nineteen low- and modest-middle income Winnipeggers, undertaken in June through September 2020. These respondents were drawn from the 29 Canadian Financial Diaries (CFD) participants who completed a year-long diary in 2019. The results...

Given the scope and the diversity of the reports and studies that examined the impacts of the pandemic on well-being, it can be challenging to absorb and understand all the ways in which quality of life has been affected by COVID-19. The well-being literature offers an approach that may help. This...

In this webinar, Commonwealth in partnership with DCIIA Retirement Research Center (RRC) and SPARK Institute present findings from our new research about drivers and considerations of recordkeeper-provided emergency savings and host a discussion with industry...

This is the second brief in a new series from The Financial Clinic. Change Matters leverages the data gathered through our revolutionary financial coaching platform, Change Machine, alongside the voices, wisdom, and lived experiences of Change Machine customers. We hope that our action oriented...

The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial...

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on...

The National Financial Well-Being Survey Report is the second report in a series from the Understanding the Pathways to Financial Well-Being project. In order to measure and study the factors that support consumer financial well-being, in 2015, the Bureau of Consumer Financial Protection (the...

The COVID-19 crisis is a public health crisis and an economic crisis. The Economic and Fiscal Snapshot 2020 lays out the steps Canada is taking to stabilize the economy and protect the health and economic well-being of Canadians and businesses across the...

This research paper investigates the association between the patterns of duration, timing and sequencing of exposure to low family income during childhood, and symptoms of mental health problems in...

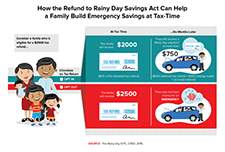

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial...

This report discusses the vulnerability of millions of people in the US who lack adequate emergency savings. A workplace-based solution—rainy day savings accounts— can potentially help workers with low savings weather financial...

The Consumer Financial Protection Bureau’s continuing effort to encourage saving at tax time is now part of a larger Bureau initiative to support people in building liquid savings. The new initiative is called Start Small, Save Up. The vision for Start Small, Save Up is to increase people’s...

The JPMorgan Chase Institute has assembled data assets and perspectives on income and spending volatility over the last three years and examined the impacts of extraordinary income changes from job loss and extraordinary expense changes, notably from medical payments. Here we take a holistic view...

This is a brief on the cost of financially insecure families to Chicago, in terms of cost of eviction and unpaid bills. The financial health of cities depends on financially secure residents. When families have little to no savings and experience a disruption in their income or expenses, bills may...

In order to monitor the financial and economic status of American consumers, the Federal Reserve Board conducted the third annual Survey of Household Economics and Decisionmaking in October and November 2015. This survey provides insights into the well-being of households and consumers, and...

About half of households are considered financially fragile, which means they’re not sure they could come up with $2,000 in 30 days if they had to. Lack of emergency savings is common. It affects about half of households that earn $25,000 to $75,000 a year, and about a quarter of households that...

This is the slide deck from the CFSI / Assets & Opportunity Network webinar on Fintech apps to support financial health. The webinar explains financial health, the goal of financial solutions technologies, the FinLab project to help wealther financial shocks through financial technology -...

These are the webinar slides from the CFED webinar on asset limits and savings possibilities for Americans on social assistance. The webinar highlights findings from 3 research studies that explore asset limits and household financial security; discusses policy changes to asset limits and their...

This report seeks to develop a clear picture of the current state of household financial security. It begins by exploring three components of family balance sheets—income, expenditures, and wealth—and how they have changed over the past several decades, and concludes with an examination of how...

This report is on the results of a survey of 150+ experts on income volatility, its causes and impact, and what to do about...

The economic health of cities and communities depends on the financial health and stability of their residents. Economically secure families are better able to weather temporary income drops independently and are less likely to rely on local services for housing support and cash assistance....

This paper examines households’ financial fragility by looking at their capacity to come up with $2,000 in 30 days. Using data from the 2009 TNS Global Economic Crisis survey, the respondents who report being certain or probably not able to cope with an ordinary financial shock of this size...

The effects of different types of debt can vary widely: some debt is considered productive by advancing young adult households' financial health while other debt can be unproductive, pushing their financial health out of reach. A savings account may help young adult households reduce their reliance...