Discover financial empowerment resources

Discover financial empowerment resources

Nonprofit organizations in Canada were significantly impacted by COVID-19, including lost revenue and needing to adjust the program delivery. The lack of technology capacity in the nonprofit sector is a key barrier for many nonprofit organizations to adapt to delivering programs online. Momentum, a...

Human insights are used when designing programs and improving services through understanding clients’ hidden preferences, environment factors and behaviors. The Human Insights Tools from Prosperity Now are intended to take you through the process of discovering opportunities for innovation from...

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial...

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth...

While social finance could have a transformative impact on the funding and financial landscape, relatively little is understood about its implications for charities. This webinar presents the results of a national survey of over 1,000 registered charities undertaken by Imagine Canada to better...

Technology can play a key role in addressing some of the financial challenges that Canadians face on a day-to-day basis. Over the last five to ten years we have seen a growing number of companies, called fintechs, that primarily use technology to change and enhance the way we do banking or access...

The Financial Literacy Outcome Evaluation Tool offers organizations a collection of evidence-based financial literacy outcomes and indicators. The tool guides users through a series of questions about their program and evaluation goals and then suggests scales (sets of questions) and individual...

As the connection between financial capability and social mobility is made evident, both public and private actors are increasingly interrogating the drivers of personal financial health and investing in the innovation of products and services designed to improve the condition of economically...

Grantmakers and practitioners recognize the importance of financial security for individuals and families, and many organizations therefore offer financial capability programs aimed at strengthening the financial well-being of the people they serve. But good financial capability programs are often...

This guide is designed to be a resource for programs working with low income families to use when anticipating or implementing a new approach, such as coaching, to doing business. It helps you to systematically – and honestly – look at your foundational readiness for change, so that the...

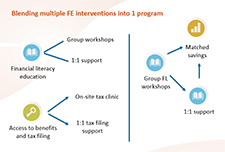

There are many different ways to deliver financial empowerment programs. Financial literacy education, financial coaching, and matched savings programs can be successfully delivered independently, with successful outcomes for participants. They can also be blended together to accomplish several...

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through...

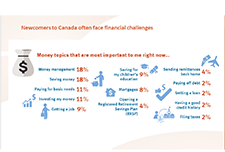

For many newcomers, living in Canada involves learning about finances and money management in new ways. This can include navigating new financial systems, and learning about tax filing and benefits, as well as day-to-day money management and saving. One-on-one financial coaching programs...

This brief uses the experiences of participants in a service design process called the Savings Innovation Learning Cluster (SILC) to gather key insights into client perspectives and how it can be used to better program design. Four human insights research and design methods are explored—client...

This document is a “how to” guide for planning and implementing evaluation activities. The manual, based on Centers for Disease Control and Preventions's Framework for Program Evaluation in Public Health, is intended to assist managers and staff of public, private, and community public...

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the...

Tax time financial capability services offered at Volunteer Income Tax Assistance (VITA) sites range from encouraging taxpayers to save a portion of their refund to free credit reviews, to referrals to financial coaching, and others in between. This report from Prosperity Now summarizes research...

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free...

This is a one-hour webinar on matched savings programs and personal savings strategies that work for people living on low incomes. Our panelists share experiences from their programs in Ontario and Calgary. The presenters in this webinar are: Dean Estrella, Momentum, Calgary, AB John...

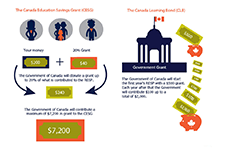

This is a one-hour webinar on increasing take up of Registered Education Savings Plans (RESPs) among people on low incomes. Our panelists share challenges and success stories in their work to help clients save for their children’s post-secondary education. Learn successful outreach strategies,...

This comprehensive resource from Prosperity Now supports organizations in developing a participant-centered financial coaching program. Grounded in a field survey, over 100 interviews, expert advice and beta-testing with six new financial coaching programs, the Coaching Guide highlights the...

This brief is a companion resource to Building Financial Capability: A Planning Guide for Integrated Services (also known as the Guide) and provides real-world examples of financial capability integration efforts. The brief shares lessons and approaches for how tribal-serving organizations can...

More than half of all employees in the United States report that they are financially stressed, and nearly one in three employees reports being distracted by personal financial issues while at work. This financial stress impacts individuals’ health, relationships, productivity, and time away...

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income...

Un nombre croissant d’organismes communautaires au Canada offrent des programmes qui aident à améliorer le bien-être financier des familles et des personnes dans leur collectivité. Certains de ces organismes préconisent également des changements aux politiques et aux systèmes pour faire en...