Discover financial empowerment resources

Discover financial empowerment resources

Investments generate different types of revenues, such as: Interest; Capital gains; Dividends. Certain types of investment revenues are more taxable than others. Several plans offer tax benefits that you can take advantage of. Thus, when you invest in these plans, the type of...

The Nova Scotia Securities Commission has investor education videos covering a range of topics from recognizing frauds and scams to learning more about investing and compound interest. Access this resource to see them...

Enrolling in post-secondary education can be expensive. The Registered Education Savings Plan (RESP) is a dedicated savings plan designed to help you save for a child’s education after high school. Learn more about how RESPs work, the types of RESPs, and the fees involved by heading over to the...

Almost all participants (Canadians and community-based organisations (CBOs)) voiced support for the idea of automatic enrolment because it would improve access to the benefit by streamlining the enrolment process for all eligible recipients. As eligible youth are from families experiencing low...

There are many ways to invest. Your choices will depend on your goals, your timeline and your willingness and ability to accept risk. It’s important to know some basics. Investing puts your money to work to achieve your financial goals. One way is to earn interest on a sum of money you invest....

There are rules about how much money a person living on Ontario Works can receive in gifts or “voluntary payments”. Generally, a person living on Ontario Works can receive gifts up to a maximum of $10,000 in a 12-month period. There are rules around reporting gifts, and decisions on how to...

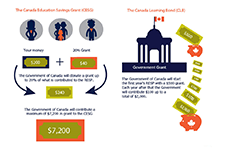

Saving for your child’s education can be difficult, especially if you are trying to save for multiple goals or pay down debt at the same time. The federal government offers contributions to your child’s Registered Education Savings Program (RESP) through its grant programs: the Canada...

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at apprenticeship programs, CEGEPs, trade schools,...

Estimate your child(ren)'s future education costs, and see how your planned RESP savings, including contributions and grants, will cover those...

Whether you’re new to investing, or new to Canada, InvestingIntroduction.ca can help. Visit the Ontario Securities Commission's refreshed website and find resources to help you make more informed investment decisions and better protect your money. The information is available in 22...

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the...

The Canada Education Savings Program (CESP) recently developed a Toolkit for Public Primary Caregivers to help child welfare organizations open Registered Education Savings Plans (RESPs) and access the Canada Learning Bond (CLB) for children in care. Most children in care automatically qualify...

The Canada Learning Bond is money that the Government of Canada adds to a Registered Education Savings Plan (RESP) to help pay the costs of full- or part-time studies after high school. If you are eligible for the Canada Learning Bond and have not already received it in an RESP, you will receive...

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular...

The ability to build assets allows an individual or family to meet long-term financial goals and create economic stability for the future. This toolkit contains resources on goal setting, action planning and information on financial products and government supports that can help with building...

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of...

This printable brochure from the Government of Canada explains the key details you need to know when choosing a Registered Education Savings Plan (RESP) for your child's education...

This fact sheet from the Government of Canada answers Frequently Asked Questions about the Canada Education Savings Plan. This includes details about the Canada Learning Bond, the Canada Education Savings Grant, and Registered Education Savings Plans...

This fact sheet from ESDC explains how to open an RESP and access the Canada Learning...

Proliteracy.ca analyzes historical living expenses from over 160 cities and tuition from over 100 universities and colleges in Canada to predict the cost of post secondary education in the future. Their tool suggests financing options based on your profile. Learn about RESP, grants, scholarships...

Introduced in 1998, the Canadian Education Savings Program (CESP) was designed as an incentive to encourage education savings for the post-secondary education of a child. The program is centred on Registered Education Savings Plans (RESPs), where savings accumulate tax-free until withdrawn, to pay...

This is a one-hour webinar on increasing take up of Registered Education Savings Plans (RESPs) among people on low incomes. Our panelists share challenges and success stories in their work to help clients save for their children’s post-secondary education. Learn successful outreach strategies,...

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career...

The Canada Learning Bond (CLB) is an educational savings incentive that provides children from low income families born in 2004 or later with financial support for post-secondary education. Personal contributions are not required to receive the CLB, however take-up remains low among the eligible...

This one-page fact sheet tells you everything you need to know to make your child's future possibilities grow! The Canada Learning Bond (CLB) is a grant of $500 up to $2000 from the Government of Canada to eligible families to help with the cost of a child’s education after high school. It...