Discover financial empowerment resources

Discover financial empowerment resources

One of the core strategic priorities identified in FAIR Canada's 2023 -2028 Strategic Plan was to conduct and share research that provides deeper perspectives directly from individual investors about key policy matters that have an impact on them. As part of this effort, FAIR Canada commissioned an...

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...

If you’re curious about Canadians experiences with buying crypto assets, you’ll want to read the results of the OSC’s Crypto Assets 2023. It provides insights into the evolution of Canadians’ crypto ownership and knowledge. Read the 2022 crypto survey results...

This study by the Ontario Securities Commission examines Canadians’ crypto ownership and knowledge. It found 13% of Canadians currently own crypto assets or crypto funds. The study also found most Canadians did not have a working knowledge of the practical, legal and regulatory dimensions of...

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have...

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world....

In September – October 2020, the Trans PULSE Canada study team conducted the COVID Cohort to assess the social, economic, and health impacts of the COVID-19 pandemic on trans and non-binary people in Canada. This dashboard serves as an interactive tool for community members and researchers to...

Internet is an essential service. As technology increasingly shapes our world, it is important that Canadians can keep up with the rapid changes, latest skills and emerging industries. Unfortunately, not every resident of Canada is able to access these opportunities to unlock a potentially brighter...

Charities and non-profit organizations play a vital role in supporting and enriching the lives of Canadians. A crowdsourcing survey of individuals involved in the governance of charities and non-profit organizations was conducted from December 4, 2020, to January 18, 2021. The objectives of the...

This study, commissioned by the Ontario Securities Commission (OSC) and conducted by the Brondesbury Group, provides some insights on the knowledge that older Canadians have about the financial realities of retirement and how they would apply that knowledge earlier in life if they are able to do...

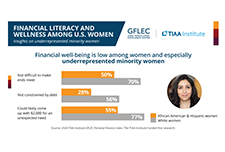

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined...

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed...

This study presents findings from a measurement of financial literacy using questions assessing basic knowledge of four fundamental concepts in financial decision making: knowledge of interest rates, interest compounding, inflation, and risk diversification. Worldwide, just one in three adults are...

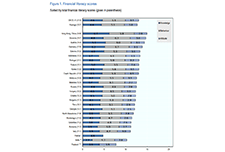

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018...

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...

This article provides a high level overview of those living in social and affordable housing by painting a portrait of them based on the results of the 2018 CHS. Socio-demographic and household characteristics are examined using housing indicators such as core housing...

Statistics Canada presents a learning catalogue to share knowledge on data literacy. Data literacy is the ability to derive meaningful information from data. It focuses on the competencies involved in working with data including the knowledge and skills to read, analyze, interpret, visualize and...

This article examines the mental health outcomes (i.e., self-rated mental health, change in mental health since physical distancing began, and severity of symptoms consistent with generalized anxiety disorder in the two weeks prior to completing the survey) of participants in a recent crowdsource...

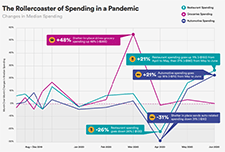

SaverLife is an organization that seeks to advance savings programs, analytic insights, and policy initiatives through a network of employers, financial institutions, nonprofits and advocacy groups in the United States. This report provides insight into the financial challenges presented by their...

This article provides a general snapshot of the employment and income impacts of COVID-19 on survey participants aged 15 to 64 living with long-term conditions and...

This report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto during COVID-19. Based on phone surveys with over 220 food bank clients in May and June 2020 and an analysis of food bank client intake data, the report demonstrates that COVID-19 has led to...

This report presents an analysis of the impact of COVID-19 on the nonprofit sector drawn from data collected in CCVO's Alberta Nonprofit Survey, data from surveys by the Alberta Nonprofit Network, Imagine Canada, and partner organizations across the country. The analysis in this report shows that...

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on...

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected...

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance...