Discover financial empowerment resources

Discover financial empowerment resources

The overall purpose of the collaborative project between Seneca College and Prosper Canada was to build a supportive booking system for tax clinics serving low-income...

The Community Volunteer Income Tax Program (CVITP) is a partnership between the Canada Revenue Agency (CRA) and local community organizations. The program is intended to ensure that all taxpayers have equal access to the tax system. In Grey and Bruce Counties, 14 community organizations provide...

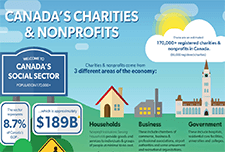

This infographic shows the size, scope, and economic contribution of charities and nonprofits across...

In 2019, non-profit organizations (NPOs)—serving households, businesses and governments—employed 2.5 million people, representing 12.8% of all jobs in Canada. The employment share ranged between 12.4% and 12.8%, increasing during the 2010-to-2019 period. While the economic and social...

The CVITP provides people, who may otherwise have difficulty accessing income tax and benefit return filing services, with an opportunity to meet their filing obligations. Often, filing a return is required to gain access to, or continue to receive, the government credits and benefits...

In 2018, over 12.7 million Canadians engaged in formal volunteering, with a total of 1.6 billion hours of their time given to charities, non-profits and community organizations—equivalent to almost 858,000 full-time year-round jobs. Today, Canadians are courageously volunteering in the...

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of...

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at different points in the tax...

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at a specific point in the tax...

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video discusses why promoting savings at tax time is a critical component of VITA...

This is a one-hour webinar on the tax filing experiences of Canadians living on low incomes, and some successful strategies frontline practitioners can use to reduce stress at tax time for participants, in their delivery of community tax clinics. The speakers in this webinar are: Nirupa...

In this presentation, John Silver, Executive Director, Community Financial Counselling Service (CFCS), Winnipeg, shares insights from the low income tax program at CFCS. This program files almost 10,000 returns each year, and also provides tax clinic support to other agencies and delivers detailed...

In this presentation, Althea Arsenault, Manager of Resource Development, NB Economic and Social Inclusion Corporation, shares insights from the 'Get Your Piece of the Money Pie' tax clinic program. This program has operated since 2010, and currently files over 23,000 returns each year. This...

In this presentation, Nancy McKenna, Manager, CVITP, Canada Revenue Agency, explains how the Community Volunteer Income Tax Program (CVITP) works. This includes eligibility requirements, the size of the program in 2017/2018, and partnerships. This presentation is from the session 'Closing the...

This infographic by Prosper Canada features advice to help Indigenous communities and organizations set up free income tax clinics. Advice was shared by clinic volunteers through a roundtable and interviews as part of the First Nations Financial Wellness...

Many volunteer income tax assistance (VITA) sites experience inaccuracy in the taxes prepared according to audits conducted by the treasury inspector general for tax administration (TIGTA). Effective training strategies may influence the accuracy rates of tax returns prepared at VITA sites....

Volunteer Income Tax Assistance (VITA) sites are a useful tool for providing free tax preparation services to low-to-moderate income people and helping them claim a range of valuable tax credits, including the Earned Income Tax Credit. In addition, they can help individuals avoid high fees for tax...

This brief highlights findings from a small-scale pilot that integrated Virtual Volunteer Income Tax Assistance (VITA) services at two New York City Head Start programs during the 2013 tax season. The New York City Department of Consumer Affairs Office of Financial Empowerment (OFE) coordinated the...

This guide is intended for community organizations that are considering joining the Community Volunteer Income Tax Program. It covers the history of the program, how it operates, and offers valuable tips for organizations preparing tax clinics. It outlines the commitment expected from host...

The goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. Module 1-2: Setting goals, saving, and planning. Module 3-5: Managing income and spending money....

he goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. The toolkit is divided into two parts: The four-part Introduction is for community volunteers. This...

The four basic pillars of any professional field—quality, consistency, accountability, and community – are attracting increasing focus from financial empowerment stakeholders across multiple sectors. When the Cities for Financial Empowerment Fund and Citi Community Development released a call...

More than $3.89 billion in federal income taxes have been returned to those with modest wages as a result of free tax preparation services offered by IRS-certified volunteers in 2014. A new breakdown of national IRS data shows that tax preparers at Volunteer Income Tax Assistance (VITA) sites and...

These are the slides from Webinar #2 in the Financial Coaching Listening & Learning Series hosted by the CFED and developed by the assets & Opportunity Network. This webinar examines key findings from the CFS Financial Coaching Census, reviews client-centred frameworks for financial...