Discover financial empowerment resources

Discover financial empowerment resources

Greater attention has been given in recent years to the role of parental wealth in the home ownership aspirations of younger Canadians. Just as the intergenerational transmission of income inequality is of concern, an increasing reliance on the "Bank of Mom and Dad" raises questions about how...

Wealth inequality, health and health equity is one in a series of ongoing think pieces from Wellesley Institute that aim to stimulate ideas and new conversations to create a fairer and healthier tomorrow. Canadians are struggling with the rising cost of living. A national survey in November 2023...

The Future of Wealth Discussion Series consist of 1-hour virtual convenings that are open to the public and bring together leaders across sectors and disciplines to consider wealth-building objectives that Aspen FSP considers critical to creating widespread household financial well-being. Click on...

Recent increases in the cost of living and declining real estate values had unprecedented impacts on net saving and wealth for more financially vulnerable households in the first quarter, such as those with lower incomes, less wealth, and in younger age groups. Statistics Canada has gathered data...

When Canadians have a financial problem, want to make a financial plan, or need help with their taxes, most simply reach out to their financial institution, adviser, accountant, or commercial tax preparer for the help they need. But who do low-income individuals turn to? A new report by Prosper...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 18 years, AFN has provided a forum for grantmakers to connect, collaborate, and collectively invest in helping more people achieve economic security. This report reflects their work over...

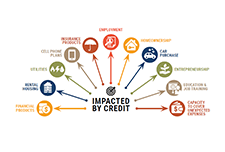

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that...

According to Employee Benefit Research Institute (EBRI), workers with household incomes of $75,000 or more are more than twice as likely to say they feel they can handle an emergency expense than those with household incomes of less than $35,000. This report outlines the results of the 2022 survey...

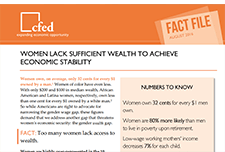

The women’s wealth gap has been largely overlooked in discussions of women’s economic security, yet wealth is the most comprehensive indicator of financial health. Without wealth, families are one paycheck away from financial disaster. The brief Women and Wealth: Insights for...

This report reveals that women of color encounter systemic obstacles to their advancement over and above the barriers faced by white women and men of color. Education and training are not the solution—women of color with high levels of education are more likely to be in administrative roles and...

Women own, on average, only 32 cents for every $1 owned by a man in America. Women of color have even less. Both the gender wage gap and the gender wealth gap need to be taken into account to address threats to women's economic...

This new Poverty Trends Scorecard consisting of four reports now presents an update of the information on income, wealth, and inequality. Over three years later, the recovery has yet to fully take hold. The individuals and families who bore the brunt of the 2008–09 recession face continuing...

By 2003, the savings and asset building field had achieved critical research and policy successes. However, some challenges it faced were the lack of a substantial presence of organizations of color in the field and the absence of experts of color at decision-making tables. Over the course of 11...

The gap between rich and poor is reaching new extremes. Credit Suisse recently revealed that the richest 1% have now accumulated more wealth than the rest of the world put together.1 This occurred a year earlier than Oxfam’s much publicized prediction ahead of last year’s World Economic Forum....

...

We define precarious employment as having an outsized level of uncertainty, whether in terms of pay, ongoing employment, scheduling, or other dimensions. Types of work associated with precarious employment are typically lower paying, with an income gap of between $11,600 and $18,000 in 2014...

This is a brief presentation by Ray Boshara from the Federal Reserve Bank of St. Louis. It shows data from the Survey of Consumer Finances "financial health scorecard." Results show the disparities in wealth for already vulnerable families, and differences by age, ethnicity, and education. No...

This Report on Equality Rights of People with Disabilities presents a national portrait of people with disabilities compared to people without disabilities based on seven dimensions of well-being, considered critical from an equality rights perspective. They are: economic well-being, education,...

As Congress debates a long-term path to American economic growth, American households confront their own daunting challenges to economic security and success. While tight budgets, polarized politics and a skeptical public constrain policymakers’ ambitions, Americans have yet to recover from the...

Reimagining financial aid to include asset accumulation for those currently disadvantaged has the potential to meet one of our most critical challenges: equipping enough students to succeed in college education to power future societal economic prosperity, at a cost individual students and our...