Discover financial empowerment resources

Discover financial empowerment resources

Low-cost accounts cost a maximum of $4 per month in banking fees. The Government of Canada and certain financial institutions have an agreement to provide low-cost basic banking services. If you meet certain conditions, you may be eligible for a low-cost account at no cost. No-cost accounts have...

Money and Youth starts with an exploration of one’s values and covers how to make good decisions – and be aware of those who will try to influence decisions and how they can go about doing so. The book then proceeds through a learning framework looking at the challenges and opportunities of...

Make it Count is a parent's resource for youth money management provided by the Manitoba Securities Commission that provides activities and tips to help you incorporate youth money management lessons into your daily routine. You can easily turn errands into education. Disponible en...

CPA Canada has a selection of money management worksheets you can use with your clients. Goal Setting Set SMART goals that are specific, measurable, action-oriented, realistic, time-framed. Financial Fitness Self-Assessment Determine how well you are currently managing your finances. Values...

In 2022, The Communities Ending Poverty network raised the following question: How can we engage youth as leaders in poverty reduction efforts? At Tamarack Institute events in July 2022, local and national youth leaders shared experiences and advice on how collaboratives could keep improving their...

Statistics Canada has created an "Opportunity for All"; a dashboard of 12 indicators to track progress on deep income poverty as well as the aspects of poverty other than income, including indicators of material deprivation, lack of opportunity and resilience. These indicators are broadly grouped...

This course is offered by the Canadian Foundation for Economic Education, a non-profit organization that works to improve economic, financial, and enterprising capability. This financial literacy course for general audiences covers a range of topics: money basics and the economy, setting goals and...

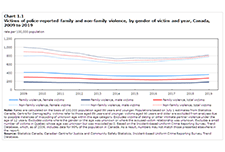

Family violence in Canada: A statistical profile is an annual report produced by the Canadian Centre for Justice and Community Safety Statistics at Statistics Canada as part of the Federal Family Violence Initiative. Since 1998, this report has provided data on the nature and extent of family...

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s...

The 2020 State of the Child Report includes six recommendations and gives a snapshot of some of the challenges New Brunswick children and youth will have to overcome as the province moves forward and juggles the new realities of public health measures to prevent the spread of COVID-19 while...

This report's release was part of Child Rights Education Week and also in celebration of the 30th anniversary of the United Nations Convention on the Rights of the Child (UNCRC). 2019 was declared the International Year of Indigenous Languages by the United Nations. The report contains an overview...

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even...

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults,...

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit...

Launched by the Centre for Gender, Diversity and Inclusion Statistics (CGDIS), the Gender, Diversity and Inclusion Hub focuses on disaggregated data by gender and other identities to support evidence-based policy development and decision...

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth...

The current pandemic has reinforced the need for additional information on the health of Canadian children and youth, particularly for those younger than age 12. Results from the new Canadian Health Survey on Children and Youth (CHSCY) indicate that 4% of children and youth aged 1 to 17, as...

Around mid-June, physical distancing measures began easing across the country, giving Canadians more opportunities to spend money. However, COVID-19 is still with us, shopping habits have changed and there are 1.8 million fewer employed Canadians now than there were prior to the pandemic. How...

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance...

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of...

This research paper investigates the association between the patterns of duration, timing and sequencing of exposure to low family income during childhood, and symptoms of mental health problems in...

The Canadian Foundation for Economic Education (CFEE) works collaboratively with funding partners, departments of education, school boards, schools, educators, and teacher associations to develop and provide free, non-commercial programs and resources for teachers and students – developed and...

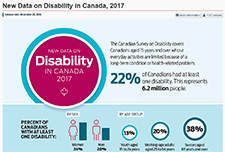

This infographic released from Statistics Canada compiles some of the data collected from the 2017 Canadian Survey on Disability. 22% of Canadians had at least one disability, representing 6.2 million...

Using pooled data from the 2012 and 2015 waves of the National Financial Capability Study (NFCS), this research finds that young adults who were required to take personal finance courses in high school were significantly less likely to borrow payday loans than their peers who were not. These...

As student loan reform continues to dominate national discourse, a NEFE-funded study shows that financial education in states with state-mandated personal finance graduation requirements causes students to make better decisions about how to pay for college. It increases applications for aid,...