Discover financial empowerment resources

Discover financial empowerment resources

Money and Youth starts with an exploration of one’s values and covers how to make good decisions – and be aware of those who will try to influence decisions and how they can go about doing so. The book then proceeds through a learning framework looking at the challenges and opportunities of...

Among the truly urgent crises facing the United States is widespread household financial insecurity. A stunning 51% of U.S. households have expenses that are at least equal to—if not greater than—their income, and 55% lack the necessary savings to weather a simultaneous income drop and expense...

Credit Canada's new budget tool lets you select the items you want to cut out of your budget (lottery tickets, daily lunch out...) and then calculates how much you will save. Click on "Access this resource" to try it...

Having a small emergency fund can alleviate major stress. Putting a few dollars away each month can help you prepare for the unexpected. Watch this new video by the Ontario Securities Commission to learn...

This handbook from Money Mentors Alberta outlines the steps to rebuild your...

Have you ever made an impulsive purchase? Do you struggle to stick to a diet or exercise routine? What’s the longest you have gone in keeping your New Year’s resolutions? The field of behavioural insights tells us that we have an innate desire to live for today at the expense of tomorrow....

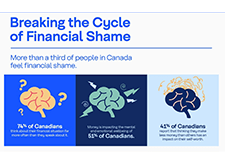

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

Inflation tells us how much prices have changed year-over-year. It’s noticeable in the cost of everyday things, for example the price of a candy bar today compared to 20 years ago. Over time, increases in inflation tend to be offset by increases in wages, since inflation and wages both tend to...