Discover financial empowerment resources

Discover financial empowerment resources

Tips and tools to help you recognize, prevent, and report scams, keeping your finances and personal information safe. Available in...

2025 figures from the Canadian Income Survey showed poverty on the rise again, erasing progress made during the pandemic and putting Canada’s 2030 targets out of reach. To reverse course, we urgently need a renewed poverty reduction strategy rooted in income security, housing support, and human...

There’s more to the college affordability crisis than the mere fact of debt. “You know, 80% of people with student debt say it causes them to delay things like getting married, buying a house, having kids,” says Aaron Kuecker, president of Trinity Christian College. “Two-thirds of folks who...

Financial Services Regulatory Authority is responsible for registering all federally incorporated loan and trust companies that do business in Ontario. They enforce the Loan and Trust Corporations Act that govern loan and trust companies. Use this website to learn more about: How to find a...

Banks in Canada are working around the clock on the prevention and detection of fraud and cyber security threats and work closely with each other and with bank regulators, law enforcement and all levels of government to protect the financial system and their customers from financial crimes. There...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 19 years, AFN has provided a forum for grantmakers and financial institutions to connect, collaborate, and collectively invest in helping more people achieve economic security. The 2023...

Gender-based violence (GBV) is one of the most prevalent human rights issues in the world. Worldwide, an estimated one in three women will experience physical or sexual abuse in her lifetime. GBV is a multifaceted issue that undermines the health, dignity, security and autonomy of women and has a...

The Aspen Institute Financial Security Program hosted a public event, “Charting a Course Towards a More Inclusive Financial System: Our Collective Call to Action,” on Tuesday, December 5th 2023. At the event changemakers in government, industry, and nonprofits spoke about their role and...

There are rules about how much money a person living on Ontario Works can receive in gifts or “voluntary payments”. Generally, a person living on Ontario Works can receive gifts up to a maximum of $10,000 in a 12-month period. There are rules around reporting gifts, and decisions on how to...

In this blog, John Stapleton breaks explains income security and personal tax systems in Canada in the simplest way...

Longevity literacy is an understanding of how long people tend to live upon reaching retirement age. It is particularly important since retirement income security requires planning, saving, and preparing for a period that is uncertain in length. This matters because longevity literacy is...

Among the truly urgent crises facing the United States is widespread household financial insecurity. A stunning 51% of U.S. households have expenses that are at least equal to—if not greater than—their income, and 55% lack the necessary savings to weather a simultaneous income drop and expense...

A prolonged period of rising inflation and interest rates has led to another significant downturn in the financial wellbeing of adult Canadians, risking their retirement readiness and security, according to the 2023 Canadian Retirement Survey from Healthcare of Ontario Pension Plan (HOOPP) and...

Widespread household financial insecurity is an undeniably urgent crisis in the United States today. A stunning 51 percent of U.S. households have expenses that are equal to or greater than their income, and 55 percent lack the necessary savings to weather a simultaneous income drop and expense...

Women’s shelters are often the first point of contact for victim-survivors fleeing abusive relationships. Therefore, safety and shelter are logically at the forefront of staff members’ immediate concerns. Once the victim-survivor is in a place of safety, it is crucial to explore the patterns of...

Discover a new quiz site to help Canadians and Canadian small businesses protect against phishing scams. The Canadian Bankers Association has created four quizzes for Canadians to learn more about cyber fraud and how to prevent becoming a victim. Quiz #1: Phish, vish, smish Quiz #2: Social...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 18 years, AFN has provided a forum for grantmakers to connect, collaborate, and collectively invest in helping more people achieve economic security. This report reflects their work over...

Six years of data from the TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) clearly demonstrate that U.S. adults with greater financial literacy tend to have better financial well-being. This report shows that retirement readiness, a specific realm of financial well-being, likewise tends...

The Association of Canadian Pension Management (ACPM) launched its new Retirement Savings Course to empower Canadians wishing to learn the basics of retirement savings and to foster awareness of the importance of retirement income savings at any age. Course highlights: Self-paced learning on...

The forced transition from in-person to online activities as a result of the COVID-19 pandemic has had a profound impact on how families and communities buy groceries, acquire medical care, and utilize social services. This rapid shift has raised important questions about how to address access and...

Banks take fraud very seriously and have highly sophisticated security systems and teams of experts to protect you from financial fraud. As a banking customer, there are also simple steps you can take to recognize cyber crime and protect your personal information and your money. Educating yourself,...

Gig workers account for approximately 25 to 35% of the national workforce. When considering workers earning low to moderate incomes (LMI), these percentages are likely higher. Gig work provides reported advantages including flexibility, supplemental income, and independence. However, it also brings...

Workers earning low to moderate incomes (LMI) continue to face challenges in financial security. The COVID-19 pandemic exacerbated the financial situation of many workers earning LMI. Along with the current macroeconomic environment, it has become even more challenging to build liquid savings for...

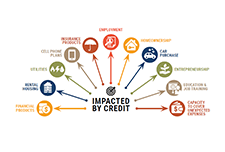

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that...

American Indian and Alaska Native (AI/AN) peoples have long faced barriers to asset building. More than half of AI/AN populations are un- or underbanked, financial services often don’t operate on reservations, and access to capital is difficult. Native peoples have been excluded from financial...