Discover financial empowerment resources

Discover financial empowerment resources

In this podcast episode, Simon Brascoupé introduces “Braiding Mind, Body, and Spirit,” a culturally relevant financial wellness resource developed with Prosper Canada and the Aboriginal Financial Officers Association of Canada. Using the braiding metaphor, the resource addresses Mind...

A culturally grounded resource to support Indigenous financial wellness. Braiding Mind, Body, and Spirit is a financial wellness bundle created by and for Indigenous individuals and communities. Developed with Indigenous teachings, community voices, and practical tools to support individuals,...

Buy Now Pay Later apps like Klarna and Afterpay have become ubiquitous since the pandemic, allowing users to pay for items in small installments over time instead of footing the bill all at once. But now, some financial experts are sounding the alarm that these easy-to-use apps can lead to...

This infographic provides a helpful visual summary of tax benefits that can add to income or reduce the taxes people in Canada pay when they file their tax return. The information is especially useful for people in Canada who: Are working or living on a low income; Live with a...

Money and Youth starts with an exploration of one’s values and covers how to make good decisions – and be aware of those who will try to influence decisions and how they can go about doing so. The book then proceeds through a learning framework looking at the challenges and opportunities of...

Financial Services Regulatory Authority, through the Deposit Insurance Reserve Fund (DIRF), provides coverage of non-registered insurable deposits, such as a chequing or savings accounts, up to a maximum amount of $250,000, while deposits in registered accounts, such as RRSPs or TFSAs, have...

York Region Plan to Support Seniors hosted an information series with John in late 2024. In these recorded sessions, John looks at what people need to know about retiring on a low-income, how to make the most of government benefits and other considerations. Session 1: What “low-income” means...

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

The Canada Disability Benefit website is managed by Plan Institute, a national non-profit organization based in Burnaby, BC. The purpose is to provide individuals, families, and professionals across Canada with up-to-date information and resources on the Canada Disability Benefit (CDB). Their...

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

The disability tax credit (DTC) is an important program for those facing severe and prolonged physical or mental impairment. Some individuals face unique barriers when it comes to completing their application and claiming the credit. On this page, the CRA is correcting some of the most common myths...

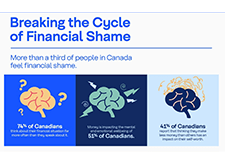

Some say money talks, but many people feel uncomfortable talking about money. However, talking openly about your finances with people you trust can be an important step in reaching your goals. It may be tough to talk about money with close family and friends, but it can be helpful. To break the...

This article by Credit Canada answers many questions around tax filing. For instance, what happens if you don't file your taxes, or you don't pay any tax owing. It also addresses the benefits of filing your taxes. Click on "Access this resource" to learn...

FCAC’s new webpage, Choosing a financial institution, will help consumers determine which type of financial institution best meets their needs. The topics covered include: Identifying the financial products and services you need Deciding if you want all your products and services with one...

Internet use in Canada is prolific, with 94% of Canadians going online for personal use in 2022, up from 91% in 2018. Not only are more Canadians using the Internet since the COVID-19 pandemic, but more are managing their personal and household finances online. Based on data from the Canadian...

Fast facts: More than 99 per cent of Canadians have a bank account 31 per cent of Canadians say they pay no service fees at all and another 45 per cent pay $15 or less per month Canadians are careful borrowers. Only 0.17 per cent of mortgages are in arrears Access this resource to read...

The report presents a summary of CDSP annual statistics up to the end of 2022. These include the RDSP take-up rates, the number of RDSP beneficiaries, and the values of CDSB, CDSG, contributions, and total assets. Starting in 2024, the program will release comprehensive CDSP statistics on an annual...

This publication is an outreach product to help promote the program "How to open a Registered Disability Savings Plan (RDSP) for yourself or a loved one with a disability". This infographic was created in response to feedback from stakeholders and was designed in collaboration with experts in...

With the holidays now behind us, it’s time to focus on what’s ahead: a fresh year full of possibilities. Many individuals have popular New Year’s resolutions involving better nutrition, weight loss and work-life balance. Yet others decide that now is the time to focus on enhancing their...

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility...

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

This free new course for newcomers consists of 4 short modules that should take 10-15 minutes each to complete. Each module includes short case studies, mini quizzes and other interactive elements. The topics for each module are: Essentials of credit in Canada How to build your credit...

This article by Credit Canada helps determine whether it's better to save for the future or pay off existing debts. The "priority pyramid" is a method of visualizing your areas of financial focus from most important to least...

In 2014, the government of BC declared October RDSP Awareness Month to help raise awareness about the Registered Disability Savings Plan (RDSP). The RDSP is the world’s first savings plan specifically designed for people with disabilities. Even with little to no personal contributions, there are...

Between the high cost of living and inflation, many of us are struggling with debt. But with financial advice available everywhere - from your uncle’s friend to social media influencers, it can be easy to feel overwhelmed and hard to know whose advice you can trust. Learning some key warning...