Discover financial empowerment resources

Discover financial empowerment resources

Financial shocks like these happen to financially vulnerable families every day. Such shocks destabilize household finances and can create hardships that threaten overall well-being. Having tools to manage financial emergencies is critical for people’s long-run financial security. The Asset...

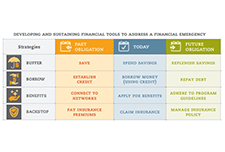

The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial...

Modern financial planning is dominated by one topic: retirement planning. However, in spite of extensive study and wide attention, retirement savings rates remain perplexingly low and remarkably resistant to policy intervention. One approach that does seem to work is employer-based education....

This is a presentation by J. Michael Collins explaining why financial coaching is a more effective intervention to achieve financial capability, compared to financial literacy. He explains the role of counseling, a definition of financial coaching, the role of the coach, and coaching as a form of...

This presentation examines the financial coaching model and suggests an approach to measure outcomes of financial coaching and financial...

This pilot study explores the delivery and effectiveness of MyBudgetCoach, a financial coaching program designed to help low- and moderate-income adults develop budgeting skills, set financial goals, and work towards those goals. Specifically, this study compares two modes of program delivery,...

This pilot study explores the delivery and effectiveness of MyBudgetCoach, a financial coaching program designed to help low- and moderate-income adults develop budgeting skills, set financial goals, and work towards those goals. Specifically, this study compares two modes of program delivery,...

This brief summarizes key findings from a pilot study of MyBudgetCoach (MyBC).1 MyBC is a financial coaching program designed to help low- and moderate-income adults develop budgeting skills and work towards their financial goals. Trained coaches use the program’s online platform...

Financial coaching is a promising strategy to help people improve their financial well-being, but is often not yet universally understood. Practitioners are turning to coaching strategies to better facilitate behaviour change as opposed to the disappointing results often found when only financial...

According to a 2013 Federal Reserve Board Survey, technology is increasingly being used by people at all income levels to manage basic financial tasks. With the popularity of smart phones increasing the convenience and accessibility of the internet, combined with the ever increasing public access...

The Center for Financial Security (CFS) and Annie E. Casey Foundation have developed a short set of standardized client outcome measures to create the Financial Capability Scale (FCS). In 2011, CFS worked with four organizations to collect data on client outcome measures, with the goal of...

In the spring of 2012, the Center for Financial Security (CFS) interviewed financial coaches at 11 organizations in order to document emerging practices and ongoing challenges for the field. The organizations were selected based on prior familiarity and through suggestions from CFS coaching...

Financial counselling may be an effective way to improve individuals’ financial behaviour and outcomes. However, its impacts have not been adequately studied. Previous studies show weak positive effects of counselling, but are subject to a number of limitations. This study, a collaboration...