Discover financial empowerment resources

Discover financial empowerment resources

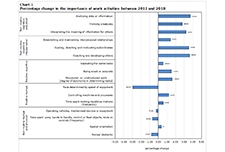

While automation has changed the nature of work in Canada over the past few decades, this change was very gradual, and did not accelerate with the very recent developments in artificial intelligence. The results of this study reveal that the share of Canadians working in managerial, professional...

Although refugee claimants seek asylum in Canada for humanitarian reasons, their labour market outcomes play a crucial role in their successful integration, which is why it is important to monitor the degree of labour market success achieved by refugee claimants. This study compares the long-term...

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of...

This Economic Insights article documents the characteristics of families with children under the age of 18 who hold registered education savings plan (RESP) investments. The article also examines the relationship between holding an RESP account at age 15 and postsecondary enrolment between the ages...

This article in the Economic Insights series reports on the cumulative earnings over a 20-year period of college and bachelor’s degree graduates from different fields of study. This article is part of a program at Statistics Canada that examines various dimensions of labour market outcomes of...